- Bitcoin mining has become easier after China's strict crackdown on crypto miners.

- The bitcoin hash rate, or difficulty level for mining, recorded its largest drop ever on Saturday.

- A crypto trader said his mining revenue jumped 50% after the difficulty adjustment.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Bitcoin mining has become easier and more profitable, as the pool of miners competing to create tokens shrinks due to China's strict crackdown on the country's crypto operations.

The level of difficulty for mining bitcoin plunged by 28% on Saturday, according to data from BTC.com, to mark the largest drop in the network's history.

Bitcoin's hash rate, which reflects the computation power needed to validate tokens, is automatically adjusted by the network's algorithm every two weeks to make sure that miner productivity is balanced. The recalibration on Saturday made it almost 30% less difficult for mining systems to complete blocks to create the cryptocurrency, so a lot more cash may be going to the miners who remain online.

Crypto trader Scott Melker said in a tweet on Monday that his daily mining revenue jumped 50% after the difficulty adjustment.

"The price of #Bitcoin dropped over 50% in a matter of weeks and China banned mining, which accounted for roughly 60% of the hashrate… and the network is unaffected," the "Wolf of All Streets" trader said. "No bailouts, assistance from a government or manipulation required. Just the free market being free."

The widespread shutdowns of mining facilities in China, which account for about 65% of activity, would have likely resulted in hash-power drops greater than the ones seen previously and to greater network congestion, FRNT Financial CEO and cofounder Stéphane Ouellette told Insider.

But the most noticeable effect of the country's anti-mining efforts may be the acceleration of bitcoin mining outside China, he said.

"During what has been a 3-month period of sustained pressure on BTC mining in China, the coin's blockchain has not displayed any signs of adverse effects," Ouellette said. "In fact, the BTC hash rate achieved an all-time high in April."

"Over the past several months, the hash rate has seen declines correlated to sell-offs - something that has historically been typical behaviour for the network," he added.

That reflects the impact of China ramping up its crackdown on mining by declaring digital tokens can no longer be used for business and the Inner Mongolia region setting up a hotline to report any outlying crypto operations that may still be active.

Bitcoin was last trading 5% lower on Monday at around $33,500, down about 47% from its peak in April. It's still up 15% year-to-date.

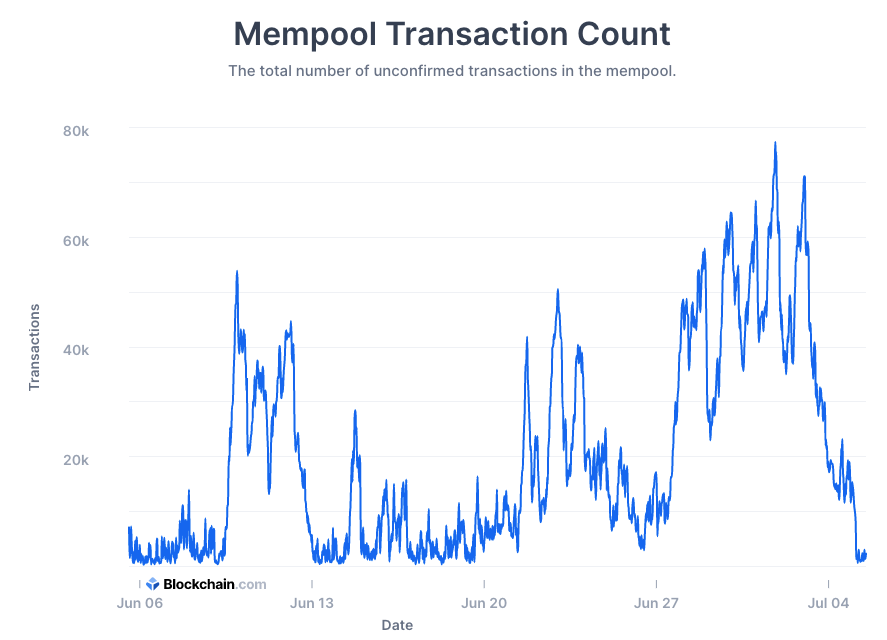

Ouellette pointed to another metric known as the BTC mempool, a "waiting area" for transactions to be picked up by miners for inclusion into a block.

This figure has been elevated over the past several months, but well below previous highs from 2017 and 2018, suggesting normal function of the network.