- Bitcoin is becoming more and more illiquid as time goes by.

- As more people buy bitcoin, the network becomes increasingly congested, and transaction times get longer.

- Transaction fees are going higher, too.

- This will be a real problem if the price crashes and everyone tries to get out at the same time.

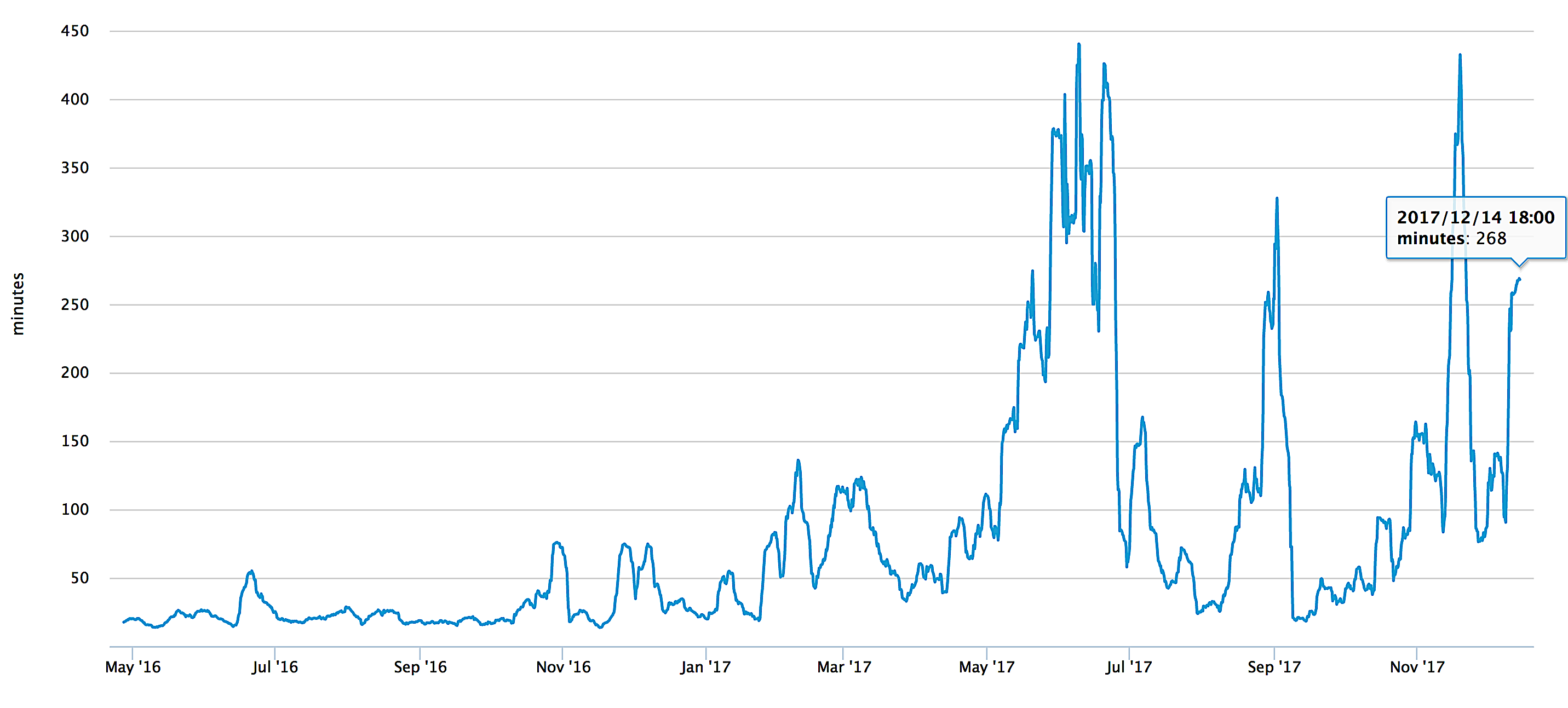

This chart shows a seven-day average of the total number of minutes it takes to confirm a bitcoin transaction, since May 2016. Like the price of bitcoin itself, transaction time has been rising as the months go by. At the time of writing, it took four-and-a-half hours to confirm a bitcoin trade, on average:

If you are holding bitcoin, and you’re worried that the price is a bubble – it cleared $17,000 last week – then bitcoin transaction times should really start to scare you. The price of bitcoin is shifting up and down by hundreds or thousands of dollars each day. No one knows what the price will be one hour from now, except that we know it will be very, very different. The schedule for the world’s largest ICO, the $500 million Dragon casino offering, has been pushed back two weeks, the company says, “due to the extreme congestion on both the Bitcoin and Ethereum Networks, [in which] ICO investors or contributors have faced significant challenges when transferring their Bitcoin and Ethereum to participate in the Dragon Pre-ICO.”

The transaction time is built into the system. Each transaction must be confirmed by six bitcoin miners, and that takes time. There is a finite number of miners, and the more transactions they have to confirm, the longer it takes as their network bandwidth gets filled. Worse, they charge for transactions and prioritise transactions based on price. Those who pay more get processed first.

Imagine how bad this is going to get on the day some negative news hits the wires and the really significant holders of bitcoin decide, “I’ve had enough of this. I’ve made my money. I am bailing.” The majority of bitcoins are held by a tiny percentage of the market. 40% are held by 1,000 people. Those few major holders can crash the market whenever they want.

As anyone who remembers the market crashes of 2000 and 2008 knows, these things happen fast. Billions get wiped off the market in minutes. People who need to cash out now, but who are an hour or so behind the news, can lose their shirts.

It is brutal.

And blockchain just isn't equipped to deal with it.

Part of the increase in transaction time has, no doubt, been caused by the recent arrival of new, less knowledgeable investors who are coming into the market only because they have seen the headlines about the price of bitcoin going up, up, up.

That gives us an idea of just how congested it will be on the way down.

It will also be expensive. By some counts, transaction fees are doubling every three months. Ars Technica reported that fees reached $26 per trade recently.

Those fees will compound the losses of people trying to sell in a crash.

By comparison, stockbrokers and banks transact trades in less than a second, usually for less than $10.

To give you an idea of how comically difficult it is to get out of bitcoin, click on this chain of tweets from a Google engineer whose screenname is @TedOnPrivacy. "I had to send pictures of my driving license and passport to some random website, which for all I know could be about as trustworthy as MtGox," he writes. "I had enough time to eat lunch while waiting for the transaction to confirm, though, so this was nice, I had roasted avocado with an egg."

It took him days. "Is it really money if you can't use it nor convert it to anything else?" he lamented.

I'm trying to sell some of my Bitcoin, and the whole process is so terrible, it's almost hilarious.

— Ted (@TedOnPrivacy) December 12, 2017