Nurphoto / Getty Images

- Bitcoin's steep sell-off on Tuesday has the cryptocurrency testing key technical levels.

- How bitcoin reacts at these levels will help traders assess trend direction in the cryptocurrency.

- "The long-term outlook remains bullish, supported by an upward sloping 200-day moving average," technical analyst Katie Stockton said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Bitcoin's volatile sell-off on Tuesday has the cryptocurrency testing make-or-break levels as key technical price points come into focus.

Bitcoin fell as much as 17% on Tuesday as El Salvador officially accepted the digital token as legal tender. The spike in volume and heightened market activity led to a flood of trade orders that ultimately caused service outages at popular crypto-exchange platform Coinbase.

Now traders are eyeing key technical levels in bitcoin that could help assess the direction of trend for the cryptocurrency going forward.

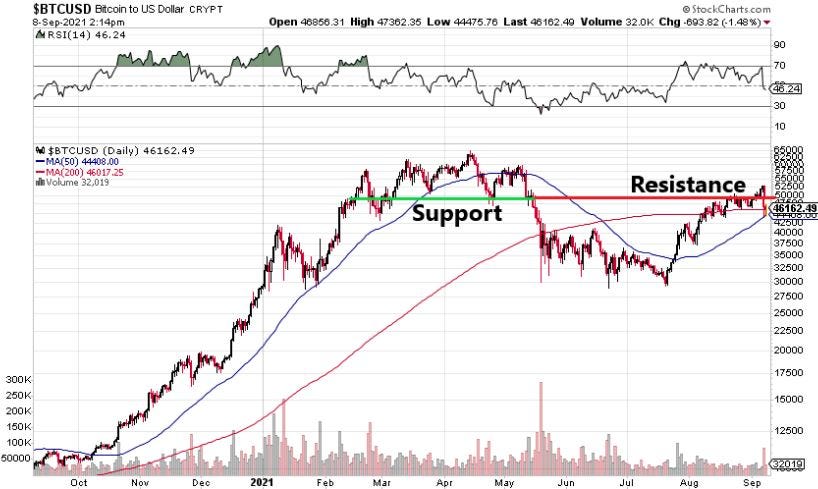

Bitcoin had confirmed a breakout above key $51,000 resistance on Monday with consecutive daily closes above that level. But Tuesday's plunge creates the potential for a failed breakout that could lead to more downside if key support levels aren't held.

Those support levels include a cluster of moving averages that are all converging between $43,000 and $46,000. The 50-day moving average currently sits around $44,400, the 200-day moving average currently sits around $46,000, and the 10-week moving average is near $43,000.

Finally, a horizontal resistance level around $47,000 is coming into play as it was previously held as support amid bitcoin's rally to a high of $65,000 in the first few months of 2021. In technical analysis, an often-followed rule is that old support becomes new resistance. With bitcoin currently trading at $46,247 at time of publication, that level is proving to be resistance while the moving average cluster is acting as support.

According to technical analyst Katie Stockton of Fairlead Strategies, the long-term outlook remains bullish for bitcoin even amid recent choppiness.

"The long-term outlook remains bullish, supported by an upward sloping 200-day moving average," Stockton explained in a note on Tuesday, adding that long-term momentum remains positive.

Accordingly, if bitcoin retakes the key resistance level of $51,000, Stockton believes a surge to its previous high of about $65,000 is in order. But a continued breakdown in bitcoin below both $47,000 and the cluster of moving averages would signal a leg lower to about $40,000, with further support levels found in the $30,000 range.