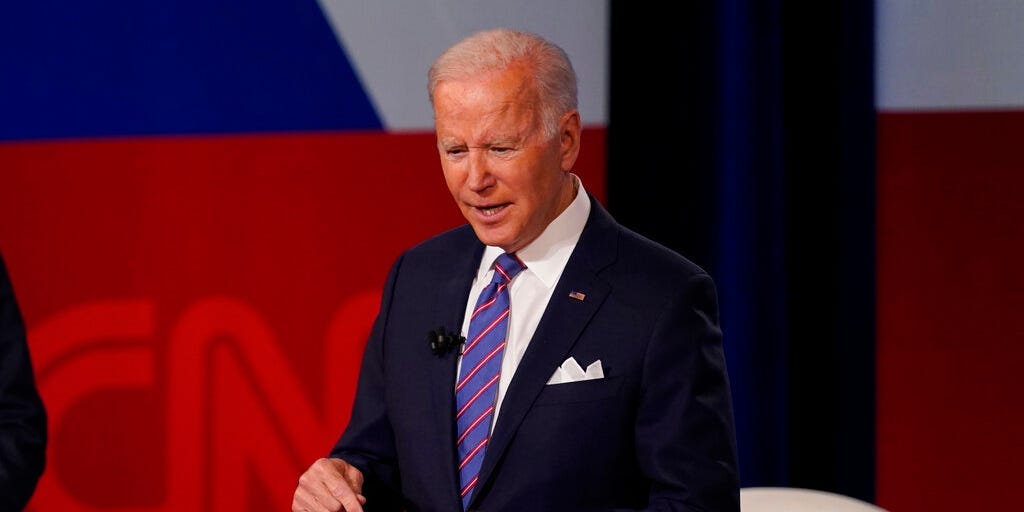

Evan Vucci/AP Photo

- Biden pushed back against Manchin's efforts to restrict eligibility for the child tax credit on Thursday.

- The president responded "no" when asked if he backed work requirements.

- Biden pitched a one-year extension of the CTC, which was slammed by Democrats for being too short.

President Joe Biden said at a CNN town hall on Thursday evening that he didn't believe people needed to work to receive the monthly child tax credit, pushing back against a key Democrat's effort to restrict eligibility for the cash benefit.

The president flatly responded "no" when asked if he backed a work requirement for the bulked-up child tax credit.

Biden's comments are pushing back against Sen. Joe Manchin of West Virginia, a centrist who holds outsized influence over the future of his economic legislation in the 50-50 Senate. Manchin has pushed a work requirement for the child tax credit over the opposition of most Congressional Democrats.

Instead, they favor ensuring families who pay little or no taxes are able to get up to $300 in monthly checks depending on the child's age. The vast majority of families earning below $150,000 are eligible for the one-year expansion, set to expire next year.

A recent analysis from the Niskanen Center indicated that at least 60% of all kids benefiting from the child tax credit would face aid cuts if Democrats adopted Manchin's idea.

The child tax credit makes up only one part of the sprawling Democratic social spending plan. Democrats also aim to include at least four weeks of paid leave, federal subsidies so people can purchase coverage from the Affordable Care Act exchanges, and more.

Biden pitched a one-year extension of the child tax credit during meetings with Democrats at the White House on Tuesday. It triggered a backlash from senior Democrats like Rep. Rosa DeLauro of Massachusetts, House Appropriations Committee chair and Sen. Ron Wyden of Oregon, who heads the Senate Finance Committee.

"I'm gonna get longer than that," Wyden told Insider on Tuesday. Other Democrats involved in the child tax credit negotiations argue a longer extension is necessary so it becomes a benefit program that's impossible to dislodge like Social Security.

"I think that we've got to try harder," Sen. Michael Bennet of Colorado, an architect of the measure, told Insider on Thursday morning.