- Biden announced he will cancel $10,000 in student debt for federal borrowers on Wednesday.

- This relief will apply to those making under $125,000 a year.

- This was a long-awaited announcement, but it was not as broad as many Democrats had hoped.

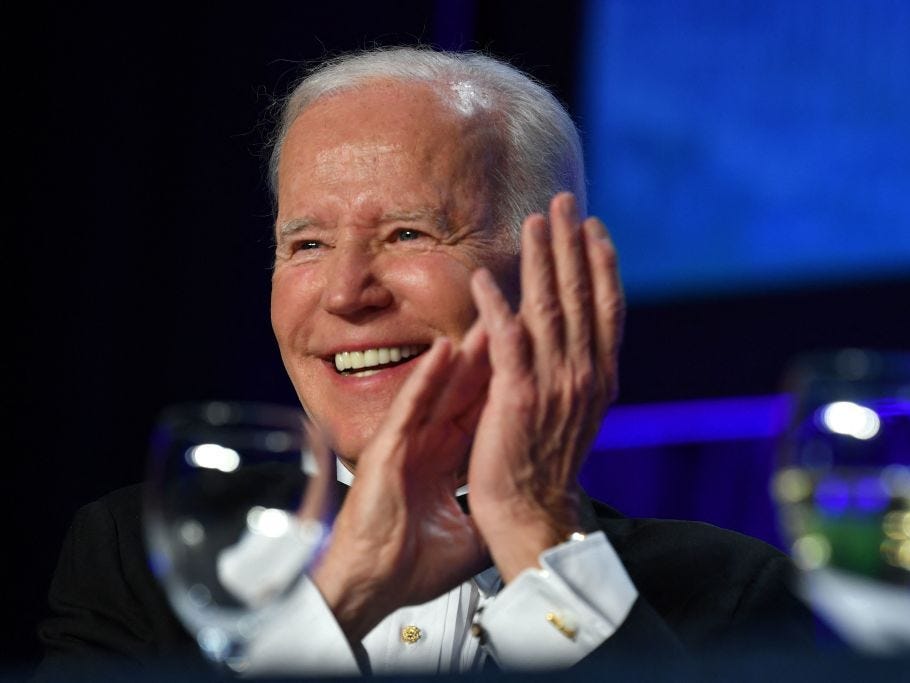

President Joe Biden has finally enacted broad student-loan forgiveness for federal borrowers.

On Wednesday, Biden announced he would be canceling $10,000 in student debt for borrowers making under $125,000 per year. This was a long-awaited announcement — on the campaign trail, Biden said he would approve $10,000 in student-loan forgiveness.

The move comes before payments are set to resume after August 31.

This amount of student-loan forgiveness was widely expected, as the president indicated during a speech at the end of April that he was not considering the $50,000 in relief sought by several progressives including Massachusetts Sen. Elizabeth Warren. Reports leading up to the announcement suggested the relief would be targeted to borrowers based on income — something that, as Insider previously reported, will be burdensome to implement.

Many Democratic lawmakers were hoping the relief would not be subjected to income thresholds. Vermont Sen. Bernie Sanders, for example, had pushed for all student debt to be wiped out. New York Rep. Alexandria Ocasio-Cortez previously told The Washington Post that high earners should not be cut out of relief.

"I don't believe in a cutoff, especially for so many of the front-line workers who are drowning in debt and would likely be excluded from relief," Ocasio-Cortez said.

With student-loan payments set to resume in a week, lawmakers on both sides of the aisle, along with advocates, were growing increasingly concerned with the announcement of relief on such short notice. "Why is the administration taking so long, and causing so much anxiety?" House Republicans on the Education committee wrote on Twitter on Monday.

Additionally, student-loan companies have expressed hesitancy with implementing student-loan forgiveness on such a short timeline. Scott Buchanan, executive director of the Student Loan Servicing Alliance — a group that represents federal loan servicers — previously told Insider that debt relief is "something that will take months to operationalize."

"That's going to take months for us to figure out how to do, especially because we're going to have to think about all sort of the implications of the interactive effect of that forgiveness with other forgiveness programs that are in place today," like Public Service Loan Forgiveness, Buchanan added.

Still, this relief will have a significant impact on millions of borrowers. According to data obtained by Massachusetts Sen. Elizabeth Warren and provided to Insider, $10,000 in loan forgiveness would zero out balances for 13 million borrowers. This moves also comes after the Education Department enacted $5.8 billion in relief for all remaining Corinthian Colleges students who were defrauded by the for-profit chain, and many lawmakers used that targeted relief as ammunition to push for forgiveness for all borrowers.

"This is a great first step," Minnesota Rep. Ilhan Omar wrote, referring to the Corinthian relief. "Now, let's cancel all of student debt."

This story is breaking and will be updated.