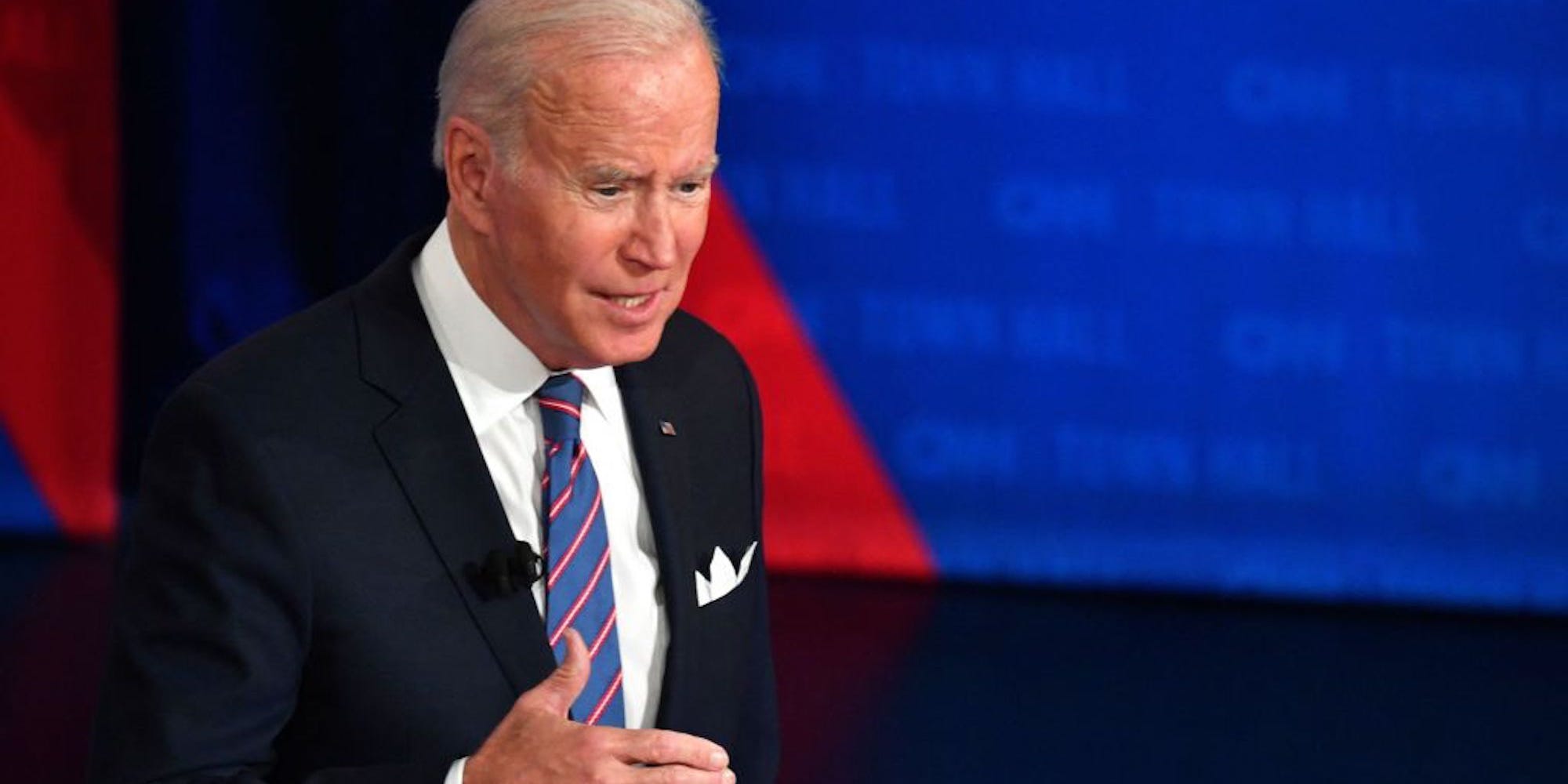

NICHOLAS KAMM/AFP via Getty Images

- Biden conceded a key part of the Trump tax law is probably here to stay due to a centrist holdout.

- "She says she will not raise a single penny in taxes on the corporate side and/or on wealthy people, period," Biden said of Sinema.

- The possible survival of Trump's tax cuts underscores the knotty maneuvering Democrats are undergoing to pass their safety net bill.

President Joe Biden conceded on Thursday evening that a key part of his predecessor's signature tax law is probably here to stay due to opposition from a centrist holdout.

During a CNN town hall, the president offered a candid assessment of the political haggling underway on his $3.5 trillion social spending plan. Swaths of the legislation are on the chopping block due to demands from Sens. Joe Manchin of West Virginia and Kyrsten Sinema of Arizona to restrain the price tag and its reach.

Biden said that Sinema had specifically told him she was opposed to raising the corporate tax rate above 21%, the level President Donald Trump locked in with the 2017 tax cuts.

"She says she will not raise a single penny in taxes on the corporate side and/or on wealthy people, period," Biden said. "And so that's where it sort of breaks down."

He also acknowledged that 12 weeks of paid leave in the package had been whittled down to four weeks, and tuition-free community college was likely out of the social spending plan because of Manchin and Sinema's resistance. Biden also said he opposed a work requirement on the child tax credit, a key Manchin demand. The president also said the inclusion of expanded Medicare benefits was "a reach."

Sinema's opposition to undoing swaths of the Trump tax law deals a major blow to Democratic efforts to fund their safety net expansion with taxes on the richest Americans and large firms. Biden had campaigned on rolling it back, calling it a giveaway to the wealthy and a burden on the national debt. Much of it could endure through the first Democratic trifecta in a decade.

"Boy, oh boy, that would be a great irony - if a Democratic president, House and Senate embraced the 2017 tax cuts," Sen. Mark Warner of Virginia told Insider on Thursday.

Democrats are eyeing alternatives that could hit the richest Americans even harder to fund their sweeping ambitions, including a new tax on stock buybacks and others specifically targeted at billionaire wealth. "As Democrats, we think it's time for billionaires and giant corporations to pay their fair share," Sen. Elizabeth Warren of Massachusetts told Insider on Thursday, adding there are "different ways" to fulfill their goals.

Asked if she was surprised that the Trump tax law could remain in place once Democrats approve their social spending bill, Warren told Insider: "Yes. The Trump tax law is a very bad idea. We should get rid of it."

Yet the possibility that chunks of the Trump tax law remains in place underscores the knotty political maneuvering that Democrats are undergoing to turn Biden's economic bills into law with razor-thin majorities. Every Senate Democrat must be onboard along with nearly every House Democrat for the package to clear the reconciliation process, which only requires a simple majority.

At the town hall, Biden recognized the outsized sway that figures like Manchin and Sinema have over his domestic agenda, given they have the ability to sink the nascent legislation if they opposed it.

"Look, in the United States Senate, when you have 50 Democrats, everyone is the president," Biden said.