Investors are worried about the US stock market.

According to Bank of America Merrill Lynch’s latest Global Fund Manager Survey, institutional investors think stocks are getting too expensive, and they’re starting to back away from the market.

For one thing, the share of fund managers who are “underweight” US stocks is a net 20%, which is a massive shift from the 1% net-overweight position of investors last month.

Big-money investors haven’t been this net underweight stocks since January 2008, during the depths of the financial crisis.

As for why investors are moving away from the US stock market, it appears that current valuations and political uncertainty are the largest reasons.

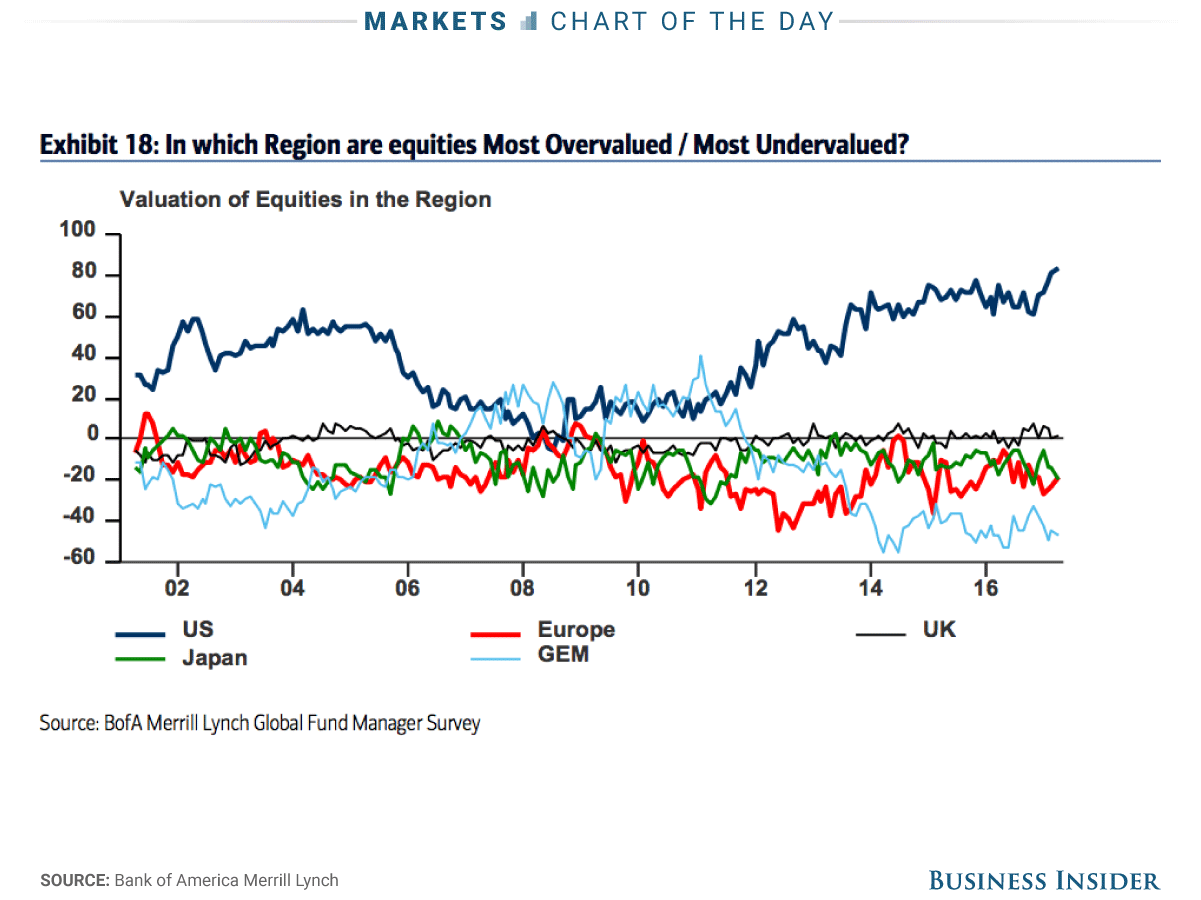

According to Michael Hartnett, the chief investment strategist at BAML, a net 83% of fund managers surveyed said US stocks were overvalued - the highest in the history of the survey. Additionally, a net 32% of respondents think global equities are overvalued, also near the highest in the 17-year history of the survey.

The other reason, Hartnett said, is the "jump in risk of delayed US tax reform." President Donald Trump's promise to slash corporate tax rates has been cited as a primary driver of the recent record high in equities. With the failure of the president's healthcare push and administration officials backing off their original August deadline for taxes, it appears that the enthusiasm among large investors is fading.