- Ark Invest is still selling Zillow after the firm revealed it's leaving the home-flipping business.

- Ark's flagship ETF has sold nearly 7 million shares over the past two weeks amid the decline in Zillow.

- "When there is a fundamental change in the story, like Zillow's decision to abandon iBuying, that violated one of our theses," Cathie Wood said.

Ark Invest is doing something it rarely does with its holdings — sell when the going gets tough rather than snap up more shares when a stock dips.

From Robinhood to Zymergen, Cathie Wood's disruption-themed investment management company has often stuck by its holdings and bought the dip whenever a high-growth company stumbled and saw a sizable stock price decline.

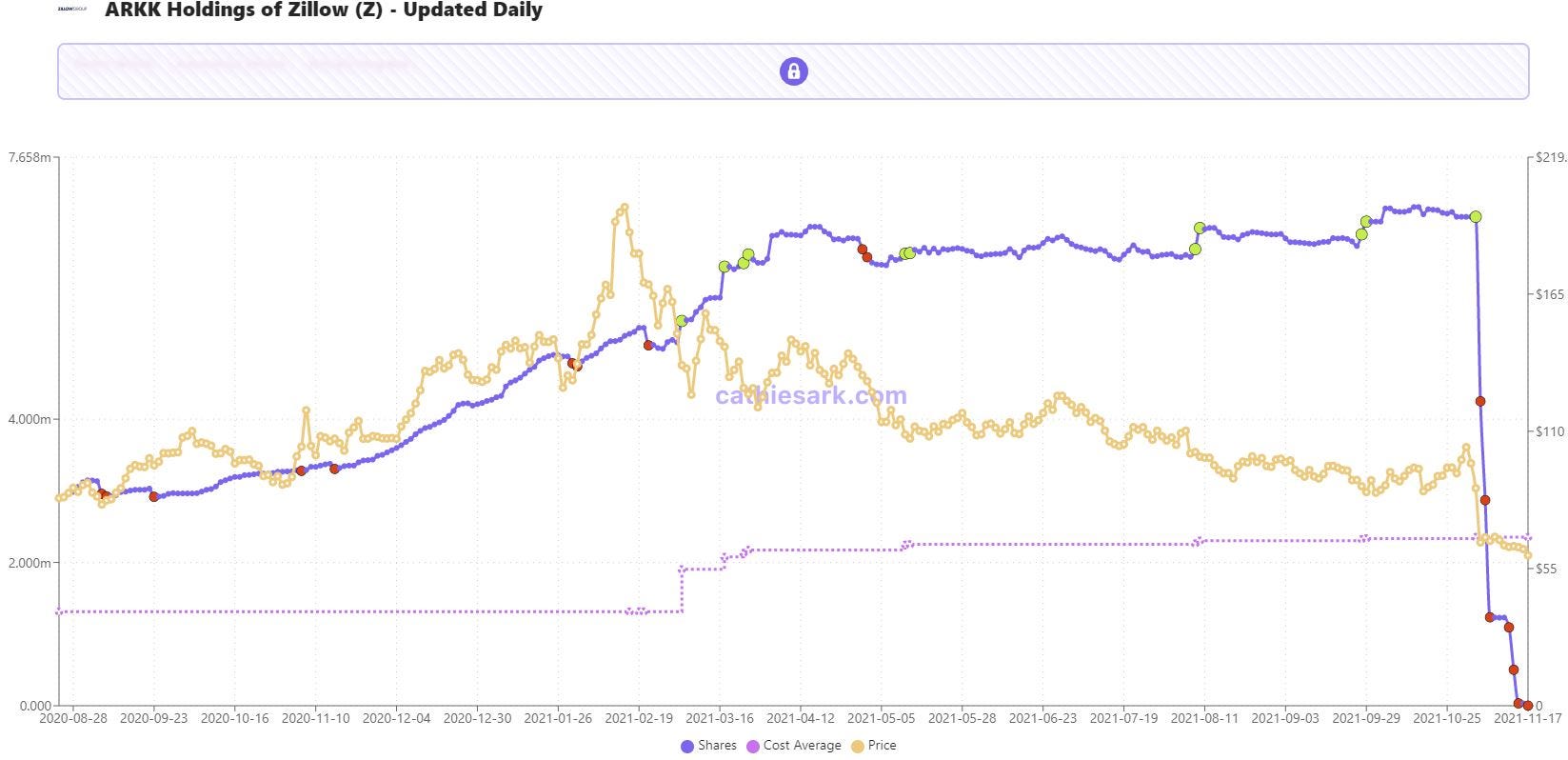

When it comes to Zillow, though, Ark has steadily pared down its stake after the online real estate firm announced that it's exiting the home-flipping business earlier this month. That news, coupled with an earnings report that missed analyst expectations, sent the stock down 40% in short-order.

Ark's flagship Disruptive Innovation ETF sold 31,361 Zillow shares on Wednesday, bringing its remaining position to just 828 shares worth about $50,000 on Thursday. The same ETF owned about 6.8 million Zillow shares at the start of November.

"When there is a fundamental change in the story, like Zillow's decision to abandon iBuying, that violated one of our theses… they've just abandoned it. And so we did sell and it's unusual for us to sell on a big drop in the stock, but we have other stocks that have gone down as well," Wood told Barron's in an interview this week.

ARK still holds 1.36 million Zillow shares, split between its Next Generation Internet and Fintech Innovation ETFs, though it has been continuously paring back those stakes as well.

Despite Zillow's mix-up in the home flipping business, Ark Invest maintains exposure to the sector, as it still believes a tech company could take the friction out of the home buying and selling process and create a profitable and sizable market.