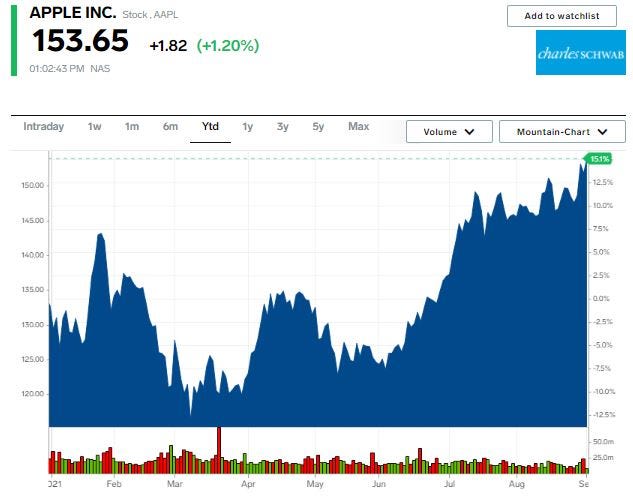

- Shares of Apple still have 10% upside potential after breaking out to record highs, according to Katie Stockton of Fairlead Strategies.

- Stockton derived a measured move price target of $168 after its breakout, and sees support around $150.

- September is often a busy month for Apple as it unveils its new slate of iPhone models.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Apple still has a lot more upside ahead following its confirmed breakout to record highs, according to Katie Stockton of Fairlead Strategies.

In a note on Wednesday, Stockton identified a measured-move price target of $168 for Apple, representing potential upside of 10% from Tuesday's close.

After decisively clearing the key $150 resistance level, Stockton sees support for Apple at that level going forward, according to the note. That level will likely serve as a better support level than the 50-day moving average, which currently sits near $145, Stockton said.

The strong move in shares of Apple has led Stockton to have an overweight bias towards the technology sector, "noting also that there is a bullish reversal in the S&P 600 Information Technology Index versus the S&P 500," the note said.

September is often a busy month for Apple, as it unveils its new slate of iPhone models at a highly-watched event. While the September invitations from Apple have not yet gone out, rumors are building as to what the iPhone 13 model line-up may offer. Potential features include a better camera, the elimination of the front screen notch, and satellite connectivity for emergency purposes.

Apple traded up as much as 2% on Wednesday, hitting a record high of $154.98. The stock is up 16% year-to-date.