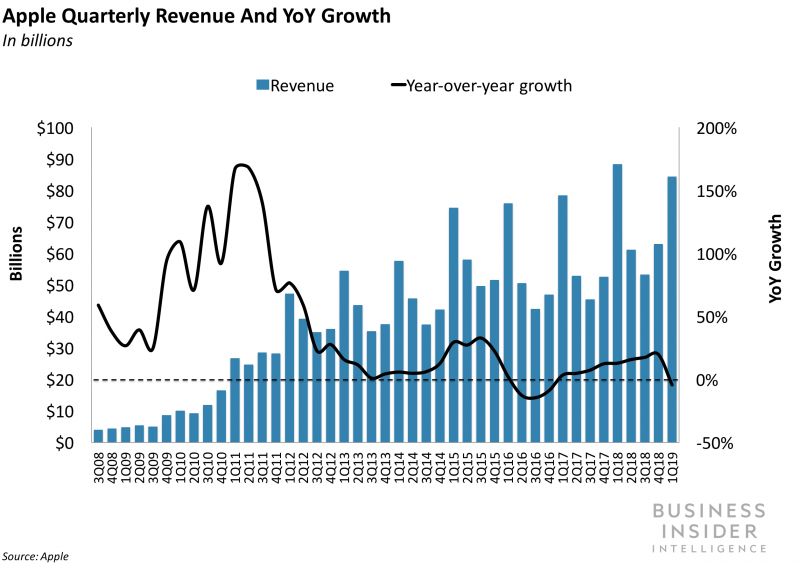

- Apple’s fiscal Q1 saw its worst performance during the holiday quarter in roughly a decade.

- The results were largely in line with a preannouncement Apple provided earlier this month.

- But Apple’s forecast for Q2 sales were at the low end of expectations.

- Apple said its installed base of iPhone users is 900 million, and it’s the first time it’s disclosed the figure.

Sales of Apple’s flagship iPhones plummeted 15% during the holiday quarter, a sharp deterioration in a business that the company said Tuesday will continue to struggle in the coming months.

Apple gave a weaker-than-expected sales-and-profit forecast for its fiscal second quarter. Its guidance calls for sales to fall by as much as 10% and for its earnings per share to plunge by as much as 22%.

On a conference call with investors and analysts, Luca Maestri, Apple chief financial officer, said problems that plagued its iPhone sales during the first quarter – a strong dollar that boosted prices in emerging markets, the reduction in subsidies from its carrier partners that lowered the upfront price of its phones, and its iPhone battery replacement program that encouraged customers to hold on to older phones longer – would continue to depress the company’s smartphone sales.

“We expect the key factors that … affected Q1 will also have effect in Q2,” Maestri said.

Perhaps breathing a sigh of relief that the results and forecast weren't even worse, investors reacted positively, bidding the stock up nearly 6% in after-hours trading to $163.45.

Apple now has 900 million active iPhone users

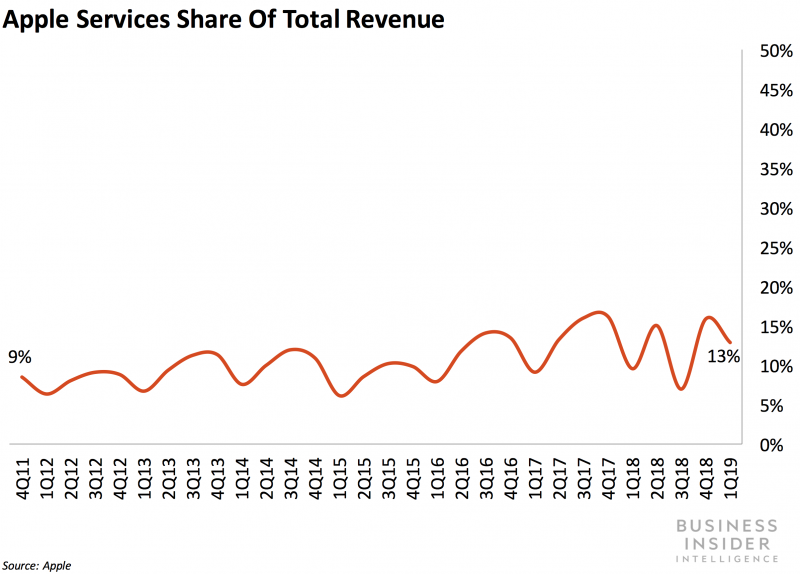

Apple said there were 900 million active iPhone users in the world - the first time the company has disclosed the size of its "installed base" for iPhones. Across all of its devices, it now has 1.4 billion active users, up 100 million from January, company officials said. Apple's plan to shift its emphasis to selling paid services, such as warranties and music subscriptions, is heavily dependent on having a large and growing base of users.

"We don't measure our success in 90-day increments, Apple CEO Tim Cook said on a conference call with investors and analysts following the report. "We manage Apple for long term."

He continued: "We are as confident as ever in the fundamental strength of our business."

Here's what Apple reported and how it compared with analyst expectations and the company's year-earlier results:

- Fiscal first-quarter (FQ1) revenue: $84.3 billion. Wall Street was looking for $83.97 billion. In FQ1 2018, Apple posted $88.29 billion in sales.

- FQ1 earnings per share (EPS): $4.18. Analysts had forecast $4.17 a share. In FQ1 2018, the company earned $3.89 a share.

- Fiscal second-quarter (FQ2) revenue guidance: $55 billion to $59 billion. Prior to the report, Wall Street had predicted $58.97 billion. In FQ2 2018, Apple saw sales of $61.14 billion.

- FQ2 EPS guidance: Apple didn't offer specific EPS guidance, but its outlook for its second quarter implies that it expects to post earnings of between $2.13 and $2.51 a share, assuming its share count falls by about the same amount it did in its first quarter. Analysts had forecast $2.62 a share before its report. In FQ2 2018, the company earned $2.73 a share.

Poor iPhone sales hurt its results

Apple's results were weighed down by plunging sales of its iPhones, its most important product line. The company posted $51.9 billion in iPhone revenue. In the same period a year earlier, it pulled in $61.1 billion from selling iPhones.

For the first time, the company did not report the total number of iPhones it sold. The company controversially announced in November that it would discontinue reporting unit sales of its products, which many analysts took as a sign Apple expected the number of iPhones its sells to decline.

With this report, though, the company did offer investors more insight into the performance and profitability of what it sees as its two major business lines - products and services.

"Within this installed base the percentage of users who are paying for at least one service is growing very strongly," Apple CFO Luca Maestri said on the conference call.

Services performed well; products didn't

Apple's services business, which includes such things as its commissions on sales through its app store, the money Google pays it for directing web searches its way, and subscriptions to its iCloud and Apple Music offerings, saw its revenue grow 19% from the first quarter of 2018 to $10.9 billion.

That growth rate is at the low end of the services-business growth rate over the past two years, which has ranged between 17% and 34%. Apple CFO Maestri cited a recently adopted change in accounting rules for some of the slowdown in the service's business growth.

Despite the growth of the services business, Apple still gets the vast majority of its revenue from its product sales, which includes sales of iPads, Macs, Apple Watches, and other devices in addition to iPhones. That business line struggled, thanks to the iPhone, with sales falling 7% from the year-earlier period.

For the first time, Apple disclosed the operating margin of both business lines. Its products business posted an operating profit of $25.2 billion, or 34% of sales. That was down from $28.6 billion, or 36% of sales in the year earlier period. By contrast, the services business posted an operating profit of $6.8 billion, or 63% of sales, up from $5.3 billion, or 58% of sales in the first quarter of fiscal 2018.

Apple's overall poor holiday quarter results weren't much of a surprise. Tim Cook, the company's CEO, warned investors and analysts earlier this month of disappointing results, saying that its revenue would likely be about $84 billion for the holiday period. Previously, the company had expected to post sales of between $89 billion and $93 billion.

Apple's shares closed regular trading down $1.62, or 1%, to $154.68.