- Earlier this year, Apple announced its own credit card, known as Apple Card.

- Apple Card will have no annual, late, or international fees, and what Apple describes as a low interest rate.

- The card will also have an easy-to-use app interface, and Apple is offering both a digital and physical version of the card.

- Apple Card will be available to US customers starting this summer, but Apple has already started testing the card with its own employees, according to Bloomberg.

- Visit Business Insider’s homepage for more stories.

Apple’s first-ever credit card, called Apple Card, is coming in just a few months.

The new card – which Apple unveiled earlier this year at an event at its headquarters in Cupertino, California – is a brand-new product line for Apple. Apple Card will have no annual or late fees, and an interest rate that Apple aims to have be “among the lowest” industry-wide.

Apple touted an easy-to-use app interface for the card, as well as a both a digital version and a sleek, physical version of the card.

Apple Card will be rolling out to US customers this summer, but Bloomberg reports that Apple has started allowing “tens of thousands” of its own retail employees to test the card. Bloomberg reporter Mark Gurman also got his hands on one, and showed off the rainbow packaging on Twitter.

Here's what we know about Apple Card so far, and how you can sign up for one yourself.

Customers will be able to sign up for Apple Card on their iPhones. Within minutes, they should be able to use Apple Card in apps, online, and at stores that accept Apple Pay.

Apple is partnering with Goldman Sachs and Mastercard for the new Apple Card, and it will be able to be used around the world.

If customers have issues with the card, they'll be able to contact Apple Card support through the Messages app - Apple says support will be available 24/7 via text.

Apple Card will be built into the Apple Wallet app on the iPhone. People who are familiar with Apple Pay should find it to be a similar app experience — the card, which is a nice rainbow gradient, will show up at the top of the app.

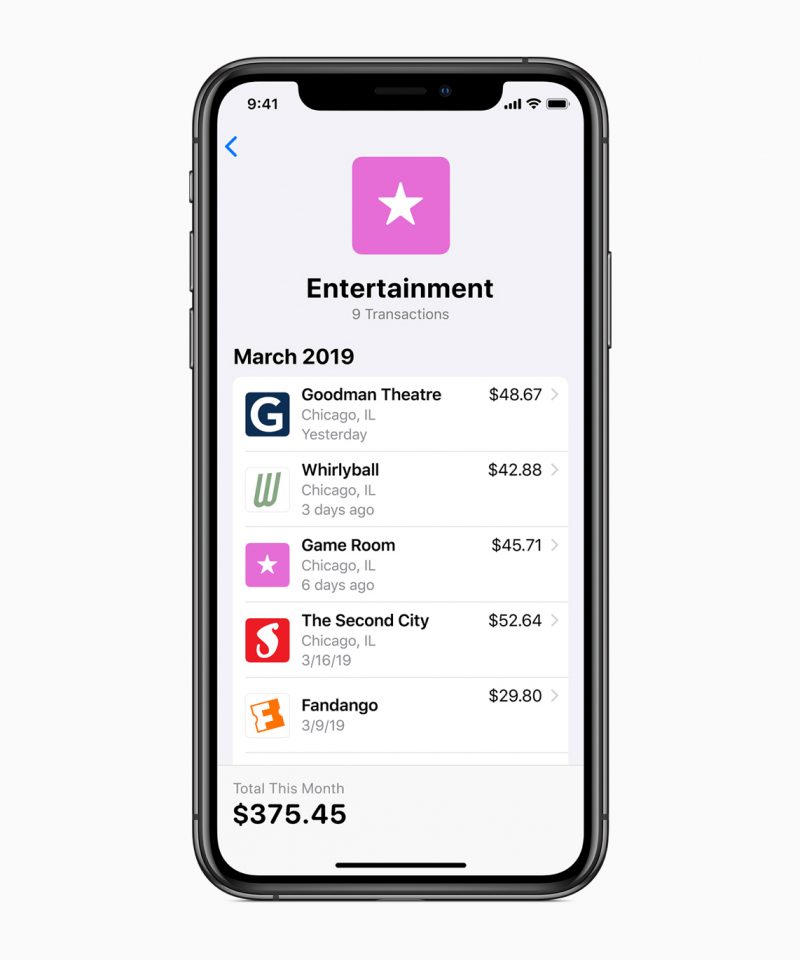

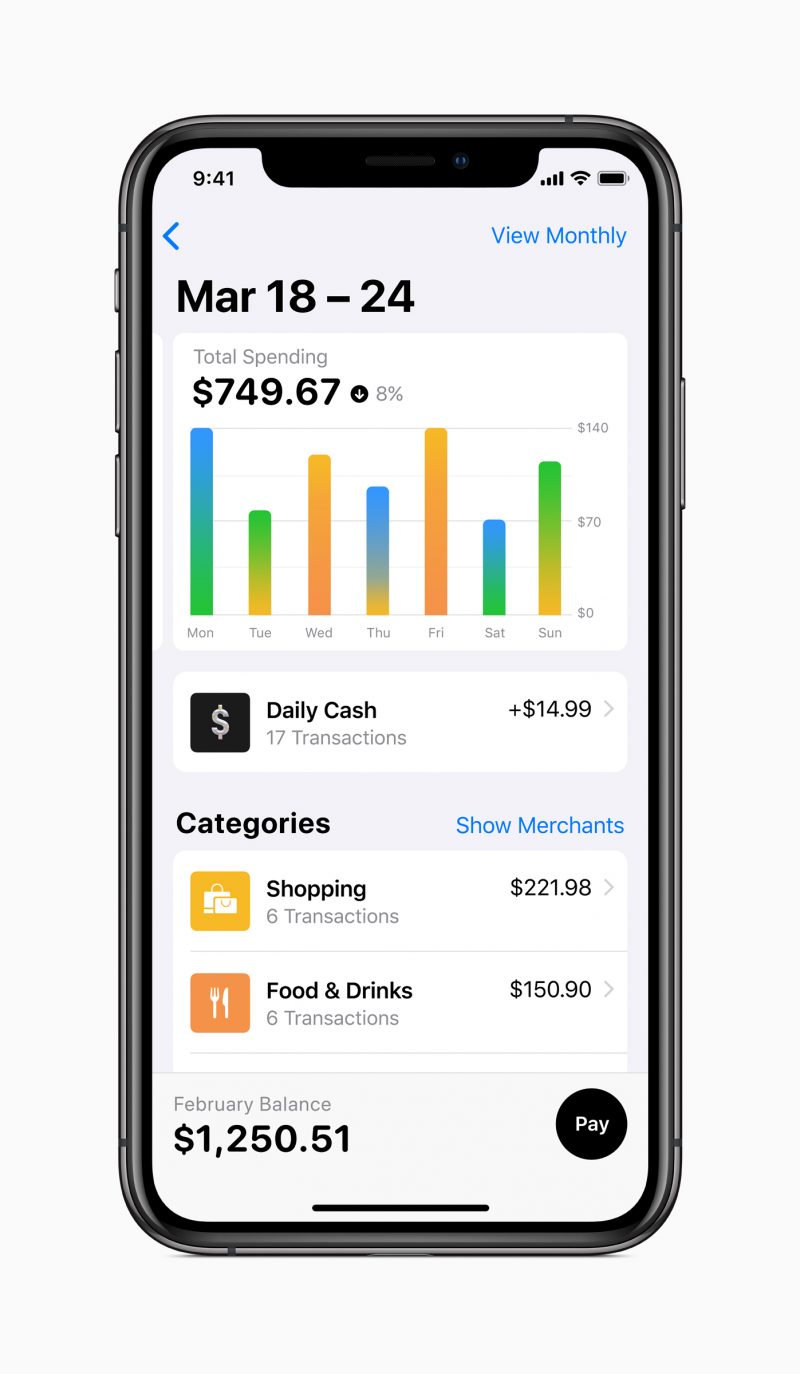

The color of your card will change in the app depending on your spending habits. Apple keeps track of your spending in a chart, and color-codes your purchases so they're easier to track over time. For example, food and drink purchases will show up as orange and entertainment will show up as pink.

Throughout the course of the month, your digital card will change color to match how you've been spending your money.

Inside the Wallet app, users will be able to easily track their spending. Apple will organize spending by category, like "Food and Drinks," "Shopping and Entertainment," etc.

Apple says it uses machine learning combined with Apple Maps to help it label purchases. Each purchase will have a date, merchant name, and location, as well as the purchase totals, which the app will calculate automatically. Here's what it looks like when you click on a transaction.

Apple Card will also provide weekly and monthly spending summaries to "help customers better understand their spending."

Apple Card offers cash back in the form of "Daily Cash." Users will get 2% cash back for using Apple Card on Apple Pay, and 3% cash back on purchases made with Apple, like Apple Store purchases or a purchase from the App Store.

Apple's Daily Cash system is slightly different from other credit cards in that the cash back is automatically added to a user's Apple Cash card every day, rather than at the end of the billing cycle.

That means that that cash back is available to be used right away on things like Apple Pay purchases, to pay off the Apple Card balance, or to send to friends or family.

Now for the most important part: fees.

Apple says there are zero fees associated with Apple Card - that means there's no annual fee, no late fee, and no fee for using the card internationally.

There will, however, be interest fees, which Apple says aim to be "among the lowest in the industry." And if a customer misses a payment or pays late, additional interest will be added to the total balance.

When users go to pay off their cards — which they can do in the Wallet app — they'll see a range of payment options, with the app automatically calculating interest costs on the different amounts.

Apple made sure to tout the card's security: Each purchase is authorized with Face ID or Touch ID and a one-time security code; and Apple won't know detailed data about users' purchases, like where they shopped or how much they paid.

Apple seems intent on promoting the digital version of Apple Card. But for stores that don't accept Apple Pay, Apple created a physical version of Apple Card as well.

The physical Apple Card is made out of titanium, and has Apple's simplicity-focused design aesthetic: it's all white, and doesn't have a card number, CVV, expiration date, or signature bar on the back.

But the perks of using the physical card aren't as good as the digital version - Apple will only offer 1% cash back when customers use the physical Apple Card, and the card is reportedly not contactless like many newer credit cards.

Bloomberg reporter Mark Gurman recently got his hands on one of the credit cards being tested.

Finally got mine pic.twitter.com/xr4TvLc8T2

— Mark Gurman (@markgurman) June 22, 2019

The Apple Card will be available in the US starting this summer. You can't sign up for the card just yet, but you can sign up to be notified about any updates regarding Apple Card.

To sign up for notifications, head over to the Apple Card landing page and click "Notify Me." Apple will send you email or push notifications whenever there's info about Apple Card.