- Apple’s fiscal third-quarter results beat Wall Street’s expectations on the top and bottom lines.

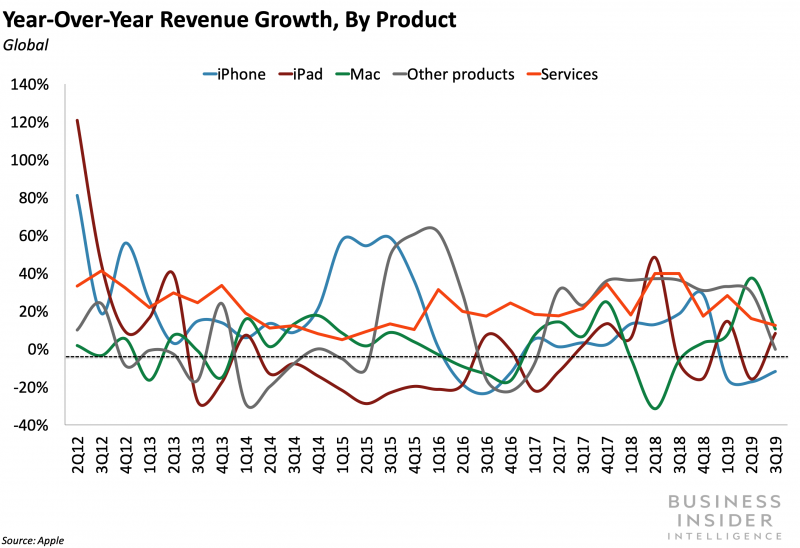

- The iPhone maker’s sales were up slightly from the year-earlier quarter, thanks to booming sales of its wearable devices and significant growth in its Mac, iPad, and services business lines.

- Apple’s iPhone sales fell 12%, but were better than analysts had forecast.

- The company’s per-share profit fell markedly, in large part due to rising research and development expenses.

- Visit Business Insider’s homepage for more stories.

Apple’s sales of its flagship iPhone continued to shrink during its fiscal third quarter, but the company edged past Wall Street’s muted financial expectations with strong results from Macs, wearable devices, and other businesses shoring up the topline.

Apple CEO Tim Cook’s comments about improving business conditions in China, which accounts for 17% of Apple’s business, further cheered investors, sending Apple’s shares up more than 4% in after hours trading on Tuesday.

“There’s several things going on there that are quite positive,” Cook said, citing a Chinese government economic stimulus and growth in its app store business in China.

While Apple’s revenue in the third quarter showed only a slight increase from the year ago period, the company’s forecasted revenue range for the current quarter, at the high end, was well above analyst targets.

Here's what Apple reported and how it compared with analysts' forecasts and its year-earlier results:

- Q3 Revenue: $53.8 billion. Analysts were looking for $53.4 billion. In the same period a year ago, the company posted sales of $53.3 billion.

- Q3 earnings per share (GAAP): $2.18. Wall Street was expecting $2.10. In its third quarter last year, Apple earned $2.34 a share.

- Q4 Revenue (guidance): $61 billion to $64 billion. Prior to the report, analysts had forecast $61 billion. Last year, Apple saw sales of $62.9 billion in its fourth quarter.

- Q4 EPS: Apple didn't offer a specific earnings target. Analysts had previously projected it would $2.69 in the period. The iPhone maker earned $2.91 a share in the same period of 2018.

Product sales were better and services worse than expected

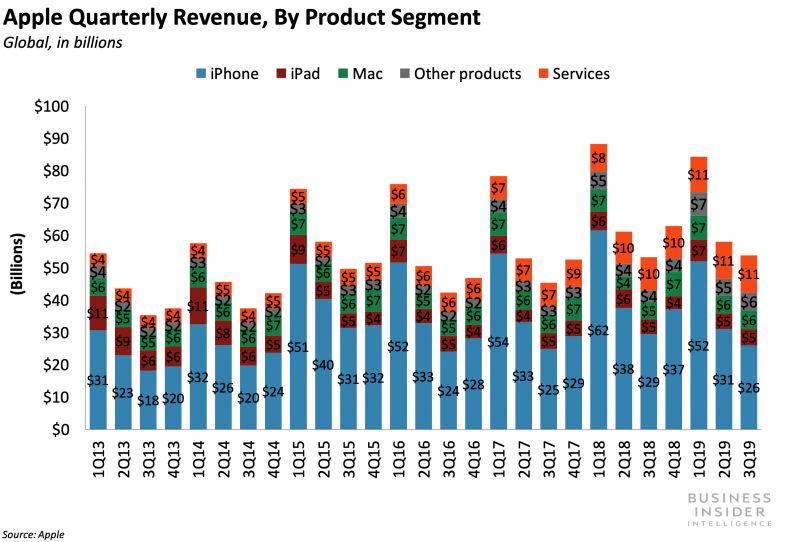

Although Apple's overall results were better-than-expected, the performance of its various business lines were mixed. Its product sales weren't as bad as Wall Street was expecting. But its services business wasn't nearly as good.

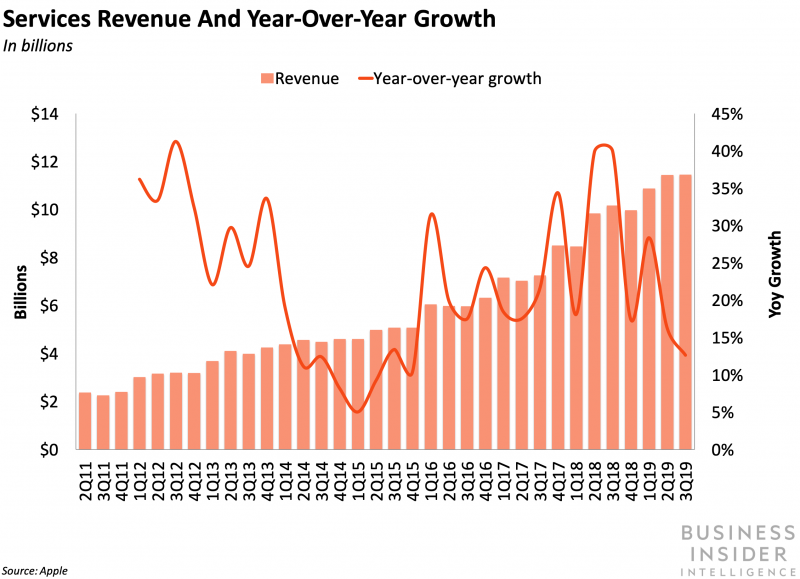

The company's services business - which includes subscription revenue from Apple Music, the money Google pays Apple to make its search engine the default one on the iPhone and iPad, and App Store sales - saw revenue of $11.5 billion in the period. That was up 12.6% from the year-earlier quarter, which was less than forecast. Analysts were expecting that business to bring in $11.9 billion in the period.

Apple has been touting its services business as one of its key growth catalysts going forward. Many analysts are expecting that business to grow at a rate of 15% or better on an ongoing basis, and in the second quarter, it grew at a 16% annual clip.

On a conference call with analysts, Luca Maestri, Apple's chief financial officer, attributed the apparent slowdown in the services business to two main factors. Last year's services results benefitted from the settlement of a legal dispute. Without that one-time windfall, the business would have grown by 15% annually. This year's results, on the flip side, were hampered by changes in foreign exchange rates, he said. If the dollar had stayed about the same, Apple's services business would have grown by 18%, he said.

Meanwhile, Apple's products - iPhones, iPads, Macs, and more - brought in $42.4 billion in sales in the quarter. That was down about 2% from the same period a year earlier. But Wall Street had forecast that Apple's products business would bring in $41.7 billion in the period.

To be sure, even Apple's products businesses showed mixed results. Its iPhone sales fell by 11.8% to $26 billion, a worse-than-expected result. But sales of its wearables, home, and accessories products grew by 48% to $5.5 billion, comfortably topping Wall Street's estimates.

During the company's conference call on Tuesday, Apple CEO Cook said that the wearables business had an "absoutely blow out quarter," citing strong growth in sales of the Apple Watch and the wireless Airpods.

Here's how Apple's various product lines performed during the fiscal third quarter (the wearables business is labelled "other products"):

Apple's stock traded up following the report. In recent after-hours trading, its stock price was up $8.97 a share, or 4.3%, to $217.75.

- Read more highlights from Apple's fiscal Q3 earnings report:

- Sales of Apple's wearables, home, and accessories products are now almost as big as the Mac business, showing that the Apple Watch and AirPods are big hits

- Apple has finally revealed when its sleek new credit card will launch

- Tim Cook says Apple wants to continue making the Mac Pro in the US following reports that it was shifting production to China

Got a tip about Apple or other tech companies? Contact this reporter via email at [email protected], message him on Twitter @troywolv, or send him a secure message through Signal at 415.515.5594. You can also contact Business Insider securely via SecureDrop.