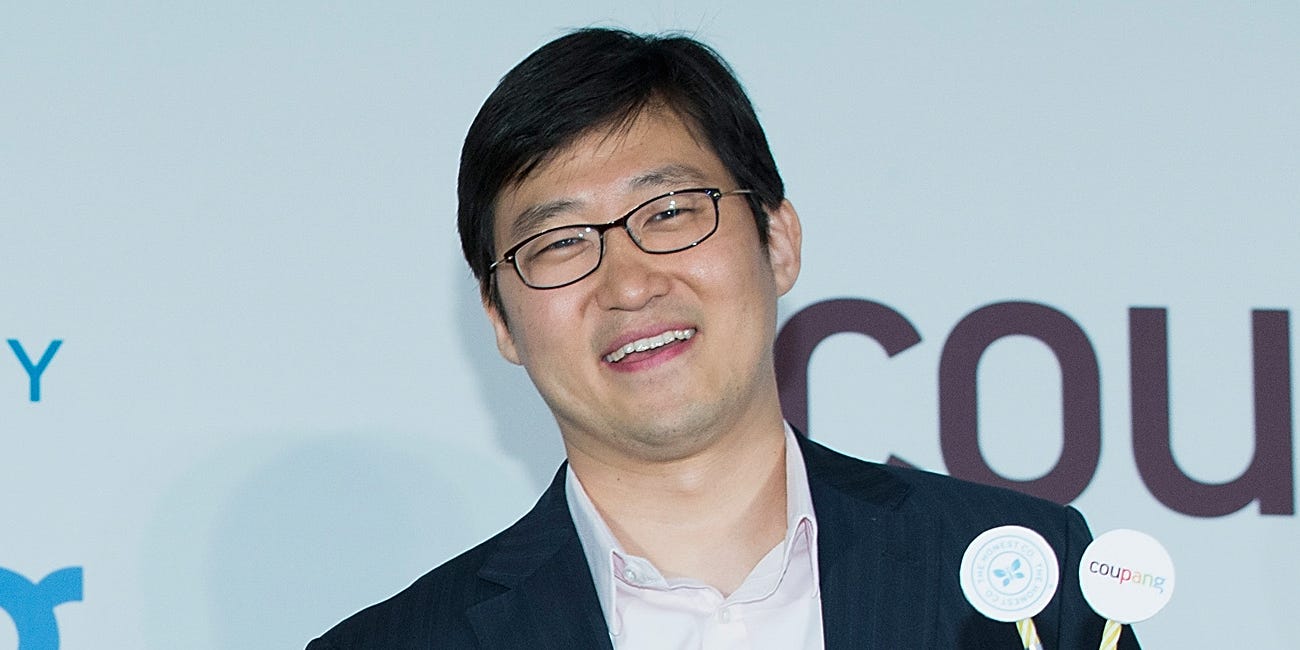

Han Myung-Gu/Getty Images

- 34 million Coupang shares will be released from a lockup agreement on March 18.

- The shares represent roughly 4.8% of the company's public float as of March 16.

- Coupang traded down on Tuesday as news broke of the upcoming lockup expiration.

- See more stories on Insider's business page.

An early lockup expiration is set to release approximately 34 million shares of Coupang held by insiders on March 18, according to the company's S-1 Prospectus.

The shares represent roughly 4.8% of the firm's 698.71 million total public float as of March 16.

The terms of an early lock-up agreement restricted Coupang insiders from selling their shares unless the company's stock traded at or above the IPO price three days after going public.

Those conditions were satisfied on March 15 as Coupang traded in at $48-$51 per share on the day.

Coupang went public on March 11 and began trading at $64.50, a whopping 84% jump from the IPO price of $35 per share. The company's IPO raised $4.2 billion for the firm at a $60 billion valuation. After the IPO, Coupang's valuation quickly swelled and the company is now worth over $84 billion.

The South Korean e-commerce giant was founded by Harvard dropout Bom Kim in 2010. In its early stages, the company attracted big-name investors like Bill Ackman, Stanley Druckenmiller, Rose Park Advisors, and more.

Then came Coupang's biggest investor, Masayoshi Son's SoftBank.

The Japanese conglomerate first invested $1 billion in Coupang back in 2015. Then, in November 2018, SoftBank's Vision Fund invested another $2 billion in the company in a deal that valued Coupang at $9 billion. The Vision Fund now owns roughly 35% of Coupang.

Billionaire investor Bill Ackman on Monday in a tweet said he was donating his shares of Coupang to the Pershing Square Foundation and another non-profit.

Despite the lockup expiration and recent jump in share prices, some analysts remain bullish on Coupang.

Ray Wang, the principal analyst at Constellation Research, told CNBC on March 12 that he likes the stock and believes the company is doing all the right things by focusing on long-term growth and a delivery buildout instead of short-term profits.

Share of Coupang traded down 6.85% as of 2:59 p.m. ET on Tuesday.