- This is an excerpt from a story delivered exclusively to Business Insider Intelligence Digital Media Briefing subscribers.

- To receive the full story plus other insights each morning, click here.

The service reportedly continues to have trouble carving out a strong position in Hollywood, as its broader content strategy remains vague, per The Information.

In addition to mismanagement and turnover at Amazon Studios – only now stabilizing under Jennifer Salke’s leadership – Amazon’s video efforts have likely struggled due to hazy brand identity. Amazon’s platform is for all things, albeit mostly for shopping.

Prime Video is merely a perk within a broader ecosystem of services, and ultimately peripheral to the key touchstone of Prime membership: free 2- or 1-day shipping. And Amazon’s emphasis on breadth has likely diluted Prime Video’s unique value, as the SVOD platform might be thought of as just another offering within the e-tailer’s broader suite.

A major constituency confused about Amazon’s identity is Hollywood talent and content producers, which could make it hard for the platform to consistently create high-quality original content. Amazon has said that it doesn’t directly compete with Netflix and other pure-play streaming giants, but that has likely confused industry talent who are unsure about what exactly the SVOD does aim to do.

Amazon has likely further diluted Prime Video’s brand as a destination for high-quality content with its relaxed policy around uploads: In its aim to flood the platform with content, Amazon enables indie filmmakers and studios to directly upload their productions to the platform via Prime Video Direct.

All platforms contend with a fear among directors that their content will get lost on the service, but on Amazon that risk seems even higher. In the talent arms race, top talent might be more likely to prioritize working with platforms that have a stronger brand identity, and whose platform revolves specifically around high-quality content distribution. That could further drive more Hollywood talent into the arms of Netflix, Disney, or HBO, which have all reliably driven mass viewing and interest.

Even if Amazon makes bigger bets on shows with so-called "global appeal," like its "Lord of the Rings" adaptation, Prime Video will continue to be hamstrung by this fundamental flaw. The best way for Amazon to clarify its value as a prominent global SVOD could be to spin out Amazon Prime Video as a distinct service, separate from automatic inclusion in Prime.

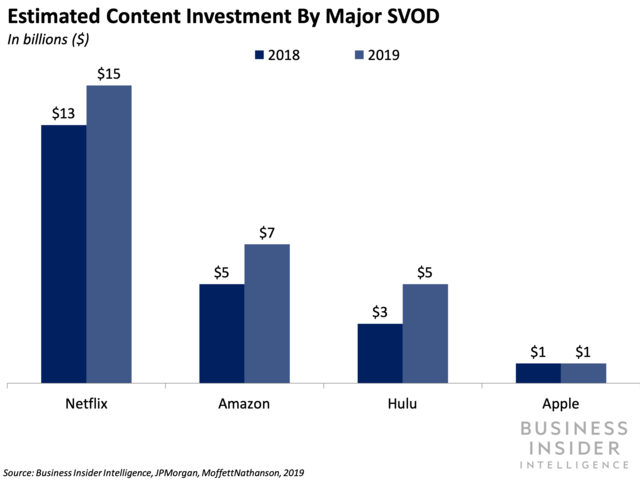

Doing so would force it to define its value separate from the Amazon ecosystem, but I don't think that's likely. As is, Amazon can offset content investment with its underlying e-commerce business, and Prime Video lifts the value of the "Prime bundle." Amazon will likely continue to play second or third fiddle to Netflix in the near term and could slip further in consumer and Hollywood mindshare as new SVOD entrants come to market.

Interested in getting the full story? Here are three ways to get access:

- Sign up for the Digital Media Briefing to get it delivered to your inbox 6x a week. >> Get Started

- Subscribe to a Premium pass to Business Insider Intelligence and gain immediate access to the Digital Media Briefing, plus more than 250 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >> Learn More Now

- Current subscribers can read the full briefing here.