Airbnb

- Airbnb’s founding trio have seen up to $9 billion erased from their combined net worth since their company’s IPO last Thursday.

- The home-rental platform’s stock price peaked at $165 during its trading debut, valuing CEO Brian Chesky’s 76.5 million shares at $12.6 billion, and directors Nathan Blecharczyk and Joe Gebbia’s stakes at $11.5 billion each.

- However, Airbnb’s stock price has tumbled 24% from its peak, wiping $3 billion off of Chesky’s net worth and $2.8 billion from each of Blecharczyk and Gebbia’s fortunes.

- The three cofounders have still made a killing as Airbnb’s current market capitalization suggests it has quadrupled in value since April.

- Visit Business Insider’s homepage for more stories.

Airbnb’s three cofounders have seen as much as $9 billion wiped off their combined fortunes since they took their company public last Thursday.

The home-rental platform’s shares surged from $68 to a peak of $165 during their first day of trading, giving the company a market capitalization of about $100 billion.

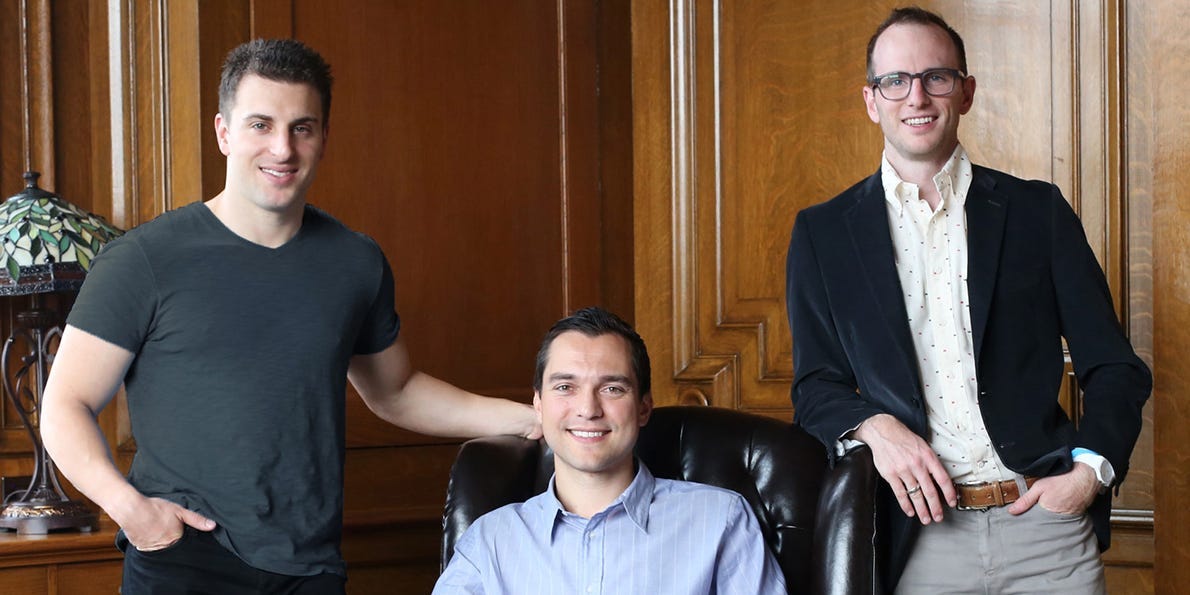

CEO Brian Chesky’s 76.5 million shares (including 9.2 million stock options) peaked in value at $12.6 billion. Strategy chief Nathan Blecharczyk and director Joe Gebbia each boasted around 69.7 million shares including stock options, meaning their individual stakes were worth as much as $11.5 billion.

However, Airbnb's stock price has tumbled about 24% from its high, closing at $125 on Tuesday. The decline has slashed the value of Chesky's shares by about $3 billion, and erased around $2.8 billion from both Blecharczyk and Gebbia's fortunes.

The trio will still be counting their blessings. Airbnb's $74 billion market cap implies it's worth four times more today than it was in April, when it was privately valued at $18 billion.

The spike in valuation is striking as Airbnb's revenue plunged as much as 80% in the spring as the pandemic hammered travel demand, spurring Chesky to lay off 25% of his workforce. Despite Airbnb's efforts to promote local bookings and cut costs, its losses more than doubled to about $700 million in the first nine months of this year.