- Maximilian Friedrich, a top fintech analyst for Cathie Wood, compared three top crypto trading apps on Wednesday.

- The analyst said Venmo is the "least competitive" because it offers fewer currencies and has higher fees.

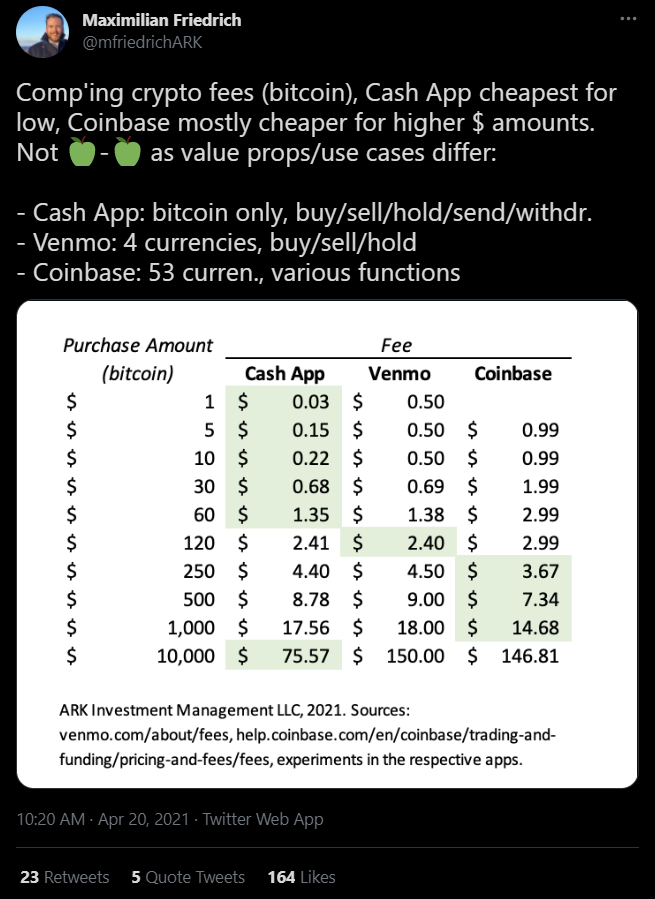

- For low-level bitcoin buyers Friedrich said CashApp was the clear winner, while Coinbase was better for larger crypto purchases.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

A top fintech analyst for Cathie Wood compared the key cryptocurrency features of Cash App, Venmo, and Coinbase, and the results may surprise you.

In a Wednesday Tweet, ARK Invest's Maximilian Friedrich went over the fees and offerings of three of the top crypto trading applications.

The analyst found that these key features varied widely between the apps and that the best option for consumers greatly depends on how much they are planning to spend in the crypto space.

As far as fees go, Cash App was the cheapest for low-level bitcoin buys, while Coinbase was better for larger crypto purchases, and Venmo was the most expensive overall.

"Venmo seems least competitive given mostly higher fees than Cash App/Coinbase while offering signific. less currencies than Coinbase," Friedrich said.

For purchases of $1 of bitcoin or less, Cash App charges a $0.03 fee, Coinbase doesn't charge, and Venmo charges $0.50.

At $5 worth of bitcoin or less, Cash App's fee moves to $0.15 while Coinbase's fee is $0.99 and Venmo charges $0.50.

At the $1000 worth of bitcoin mark, Cash App charges $17.56 while Coinbase charges $14.68 and Venmo charges $18.

As far as functionality goes, Coinbase was the clear winner. The app allows users to buy, sell, hold, send, or withdrawal 53 digital currencies.

Cash App only offers those features for bitcoin, while Venmo offers buy, sell, and hold features for bitcoin, ethereum, litecoin, and bitcoin cash, but doesn't allow for withdrawals or P2P payments.

Freidrich wrote in his Tweet that these comparisons aren't apples to apples given the different use cases for each platform. He also notes that fees may differ for different users on the applications.

The ARK analyst added that he expects Paypal, the owner of Venmo, the enable P2P crypto payments on its platform soon.

While Coinbase has been focused on the crypto space since its founding in 2012, Cash App started allowing crypto transactions in 2018 and PayPal's Venmo announced its entrance to the crypto space just this Tuesday.

Commenters on Friedrich's post quickly pointed out that popular apps like Robinhood, Binance, and BlockFi weren't included in the analysis. Coinbase's Pro version also wasn't evaluated.