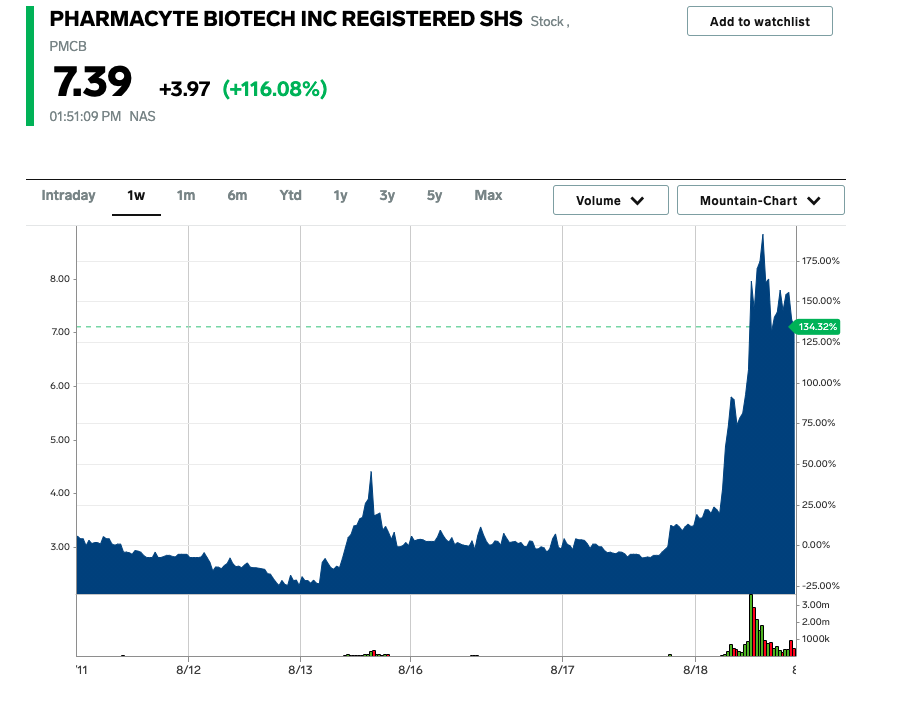

- Pharmacyte Biotech Inc. spiked 187% Wednesday as investors cheered on the CEO's vision for the company following its Nasdaq debut.

- Users on Stocktwits commented that the stock will go "to the moon."

- The biopharma company's CEO said its recent Nasdaq listing will help improve liquidity and elevate its public profile.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Pharmacyte Biotech Inc. spiked 187% to as high as $9.84 per share Wednesday as investors cheered on the CEO's vision for the biopharma company following its Nasdaq debut.

The Laguna Hills, California-based firm debuted on the Nasdaq exchange last week and now will have the ability to improve liquidity, enhance shareholder value, and elevate its public profile, according to a statement from CEO Kenneth Waggoner.

$PMCB was the top trending ticker on Stocktwits as retail traders rallied around the stock's intraday surge.

"$PMCB imagine selling now and seeing this at 25-30 tmwr ? hold through the day and see!" one user commented.

"Send us to the moon," another said.

Over 152 million shares changed hands Wednesday, compared average trading volume of 431,255.

"By listing on Nasdaq, we can leverage the Nasdaq shareholder engagement and intelligence tools, visibility platform, issuer advocacy and support, and client network that will provide greater opportunities for us to succeed in today's competitive marketplace," Waggoner said.

Pharmacyte Biotech says it's developing cellular therapies for cancer and diabetes based upon a proprietary cellulose-based live cell encapsulation technology known as "Cell-in-a-Box."

In the fourth quarter of 2020, the company assembled a team of experts to work through the US FDA's clinical hold requests in order to achieve an open Investigational New Drug Application, Waggoner said.

"Our current focus is to comply with the FDA's requests as soon as possible. When we make significant progress towards that goal, we will advise our shareholders and the investment community," he added.

Waggoner also said that the company's "necessary reverse stock split" last week enabled the company to attract institutional investors. PharmaCyte announced the closing of a $15 million public offering last week.