Joe Raedle/Getty Images

- Matt Braynard worked as a data analyst on the 2016 Trump campaign.

- His group, Look Ahead America, was founded in 2017 as a nonprofit.

- But the IRS revoked the group's tax-exempt status after it repeatedly failed to disclose spending.

- See more stories on Insider's business page.

A group founded by a former Trump campaign staffer that is organizing a rally this month on behalf of January 6 defendants is soliciting "tax-deductible" contributions despite losing its tax-exempt status last year.

According to its website, Look Ahead America is a "non-profit organization" founded by Matt Braynard, a former data analyst on the 2016 Trump campaign. Although ostensibly "non-partisan," it has clear and avowed sympathies: On September 18, it is organizing what it calls a "#JusticeForJ6" rally at the US Capitol, conflating those arrested for taking part in the pro-Trump January 6 riot with "political prisoners."

At least 638 people have been arrested and charged with crimes related to the January 6 insurrection, when rioters sought to prevent the congressional certification of President Joe Biden's victory in the 2020 election. But while claims of mass voter fraud have been readily debunked, Braynard, like others, has raised a substantial sum of money to prove that it existed.

Insider

In the weeks after the election, Braynard raised more than $675,000 on a Christian fundraising platform to pursue amateur audits of the November vote. That campaign left him with what he described as a "surplus" of $84,000, which would go toward a "relaunch of Look Ahead America." None of the money would benefit Braynard personally, he insisted. "That should be clear on the public 990 we file at the end of this year," he wrote in a January update, referring to the mandatory spending disclosures that nonprofits are supposed to file with the IRS.

A month later, the group had already raised another $75,000, Axios reported, with part of the money going to a new treasurer who was said to be resolving its issues with the IRS.

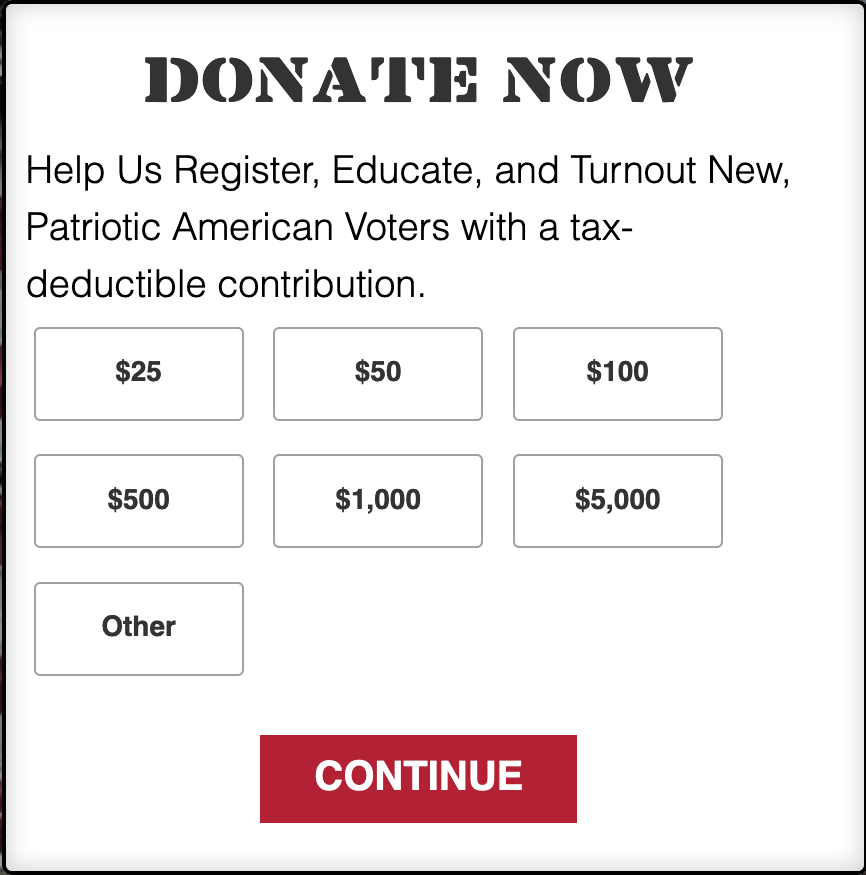

On its homepage, Look Ahead America - now boasting of a dozen-strong leadership team - is asking for more money, saying it is needed to help "organize and guide patriotic citizens in lobbying their state legislatures and local governments on America First initiatives."

Despite no longer enjoying tax-exempt status, however, potential supporters are promised that their donations will constitute a "tax-deductible contribution."

Visitors can also purchase copies of "Otoya: A Literary Journal of the New Nationalism," edited by Braynard. The magazine's cover features an image of Otoya Yamaguchi, a member of the Japanese far-right who assassinated the head of his country's Socialist Party in 1960 - and who is today an inspiration for extremists here in the United States, according to the Institute for Research and Education on Human Rights.

'The answer to that is no'

Despite promising one, Bryanard's group has never actually filed a 990 form, that would, among other things, reveal just how much he and others are paid. After three years of failing to disclose such spending, the IRS automatically revokes a nonprofit's tax-exempt status; for Look Ahead America, that happened in May 2020.

Braynard told BuzzFeed he's working on it. He reapplied for exempt status in January 2021, he said in August and was still waiting to hear back.

On Twitter, however, he suggested that already should have happened. And the former Trump staffer event insisted that his group can continue to operate as a nonprofit - and receive tax-free contributions - despite losing its tax-exempt status. "Per IRS rules, we are allowed to operate as a [501(c)(3)] while our reinstatement status is pending. We expect it to be resolved this month," he wrote in July.

Is that true, though?

"The answer to that is no," Rick Cohen, chief operating officer at the National Council of Nonprofits, told Insider. "From the time their status as a 501(c)(3) is revoked until such time that it is reinstated, donations are not deductible."

As of August 9, Look Ahead America has still not been reinstated, per the most recent IRS list of active tax-exempt organizations in Washington, DC. And until it is, the IRS too says it should not be acting like it has been.

According to the agency, there is no exception: "a section 501(c)(3) that loses its tax-exempt status can't receive tax-deductible contributions."

Neither Braynard nor Look Ahead America responded to requests for comment.

Have a news tip? Email this reporter: [email protected]