Andia/Getty Images

- 43% of fund managers surveyed by BofA said that "long bitcoin" is the most crowded trade right now.

- BofA said that past peaks in crowded trades have been associated with market tops.

- The survey also revealed fewer fund managers than last month think bitcoin will outperform in 2021.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

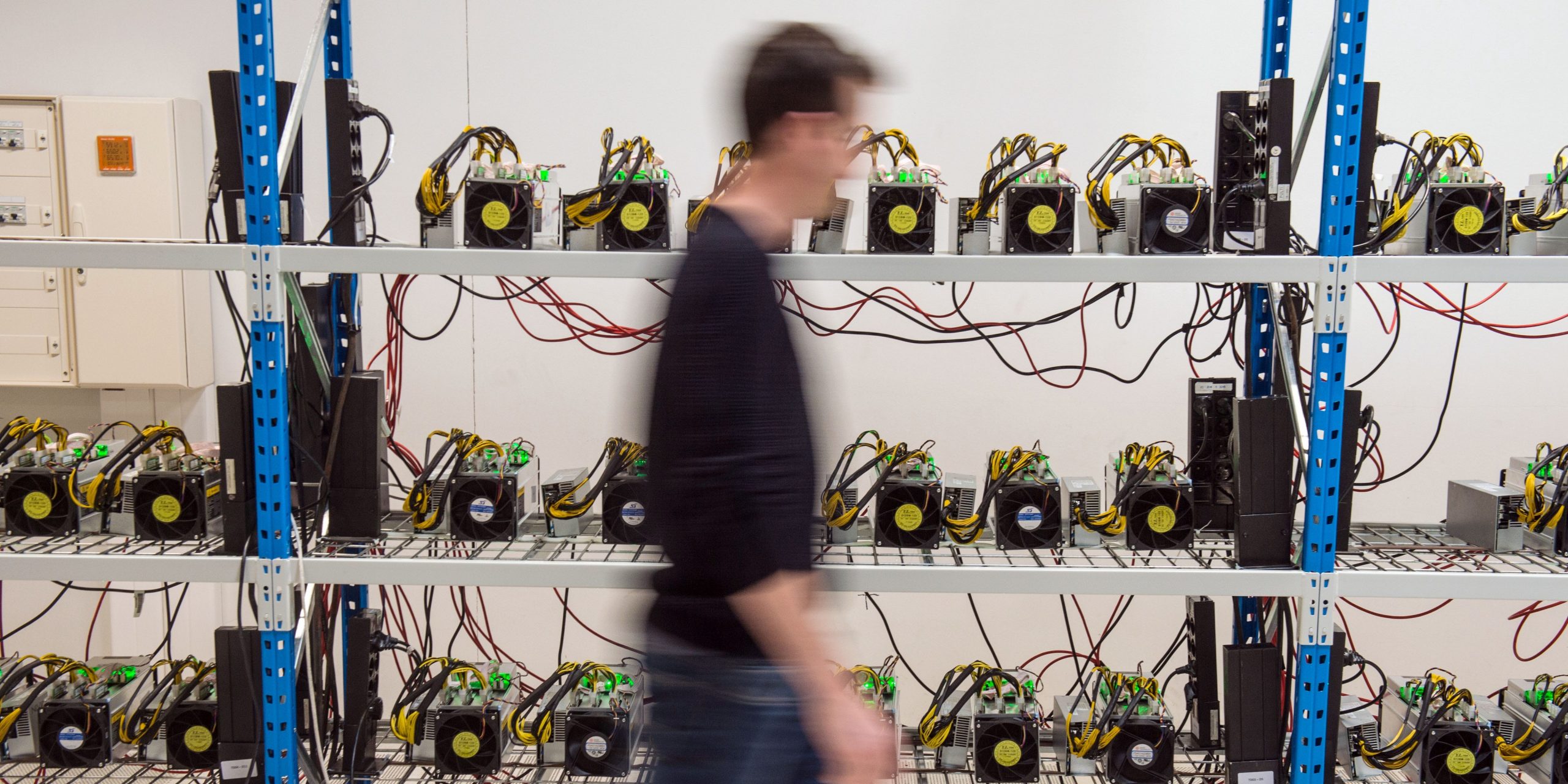

Bitcoin is now the most crowded trade in the world, according to fund managers surveyed by Bank of America.

43% of fund managers surveyed by BofA said that "long bitcoin" is the most crowded trade right now. Bitcoin was also voted most crowded trade in January of 2021, but was overtaken by "long tech" for the last three months.

Bank of America noted that in the past, peaks in crowded trades have been associated with tactical tops in relative performance, like in tech stocks in September 2020 and 2019, US Treasuries in March 2020, and the US dollar in January 2017.

Additionally, just less than 15% of fund managers say bitcoin will outperform the market in 2021, that's down from 15% who said so in the April survey.

Bitcoin was up around 1% to $45,097 on Tuesday, but it's still down 30% from its record high near $65,000 from April. The world's largest cryptocurrency has pulled back amid a slew of tweets from Elon Musk regarding bitcoin's energy consumption. Musk hinted Tesla may sell its bitcoin holdings, but clarified later that Tesla had not sold any bitcoin, which it bought for $1.5 billion in January.

Most bitcoin enthusiasts say the cryptocurrency's recent sell-off is normal and expected for an asset that has already gained 51% year-to-date. Billionaire crypto investor Mike Novogratz told Bloomberg bitcoin may be stuck between between $40,000 and $55,000 for a few weeks before ending the year much higher.

Prior to 2021, the last time "long bitcoin" was voted the most crowded trade was in December 2017, during the cryptocurrency's last rally.

Bank of America surveyed a total of 216 panelists with $625 billion assets under management from May 7 to May 13 2021.