- A majority of people will save rather than spend future government stimulus checks, according to a survey conducted by Bank of America.

- The biggest change in planned use of funds from a government stimulus check relative to 2020 came in the investing, paying off debt, and saving categories.

- Only 36% of survey respondents said they would spend the money from a stimulus check.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

A majority of the upcoming $1,400 government stimulus check will be saved rather than spent, according to a survey conducted by Bank of America.

In a note on Wednesday, the firm highlighted the results of its survey to combat the idea that inflation is going to see a sustained spike, as the bank sees a bulk of the upcoming stimulus check not flowing into the economy. BofA surveyed 3,000 people at the end of February about what they they would do with another stimulus check.

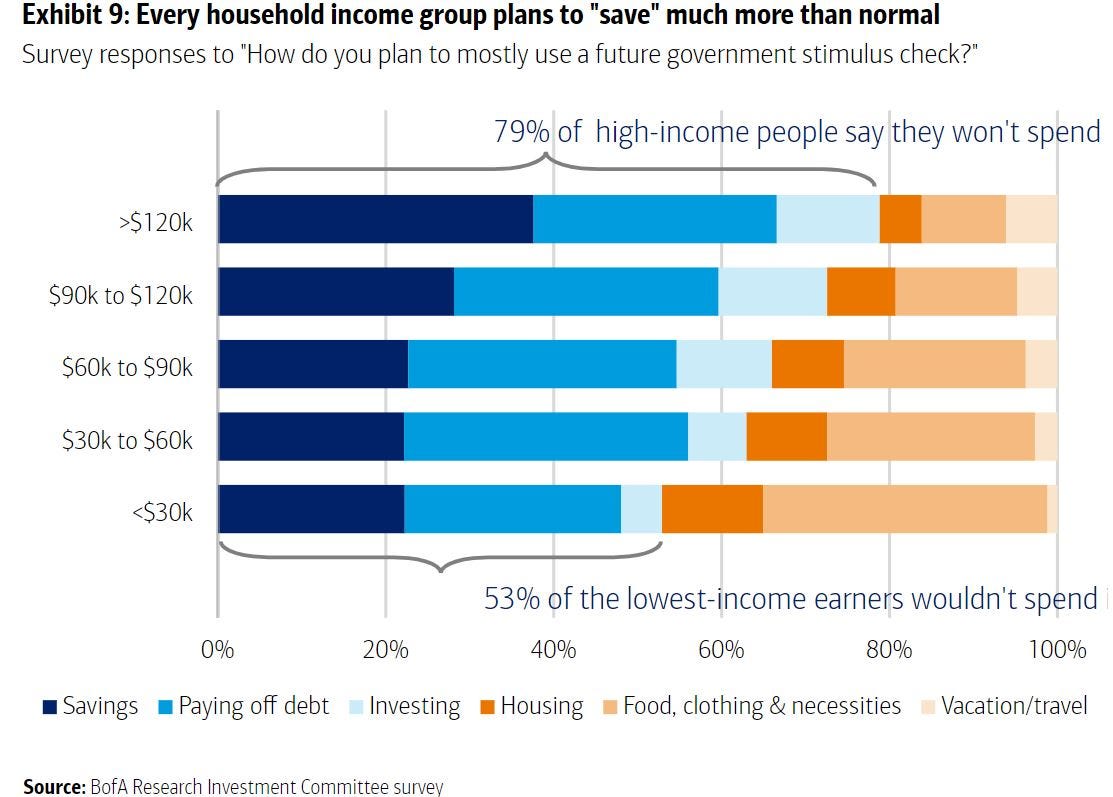

Only 36% of respondents said they would spend the money, with 30% saying they would pay off debts, 25% saying they would save it, and 9% saying they would invest it.

"We group all three of these as 'saving' in a broad sense, since the payments stay within the financial system and don't create demand for goods and services in the real economy," BofA explained.

The findings are consistent regardless of annual income. For high-income respondents who make more than $120,000 per year, 79% said they would save the money from a stimulus check, while 53% of low-income earners who make less than $30,000 said they would save the money.

The survey results of consumers' plan for stimulus money has changed dramatically relative to 2020, when economic uncertainty was higher than it is today amid the pandemic. The biggest change came in the savings category, which saw a 2.3% increase relative to last year. The vacation and travel categories also saw a boost in planned spending with proceeds from a government check.

The category that saw the biggest decline in planned uses from a future government stimulus check was the food, clothing, and necessities category which dropped about 5%, according to BofA.

"If most savings are stuck with wealthy households unlikely to spend, and the bottom 80% devote their excess cash to debt, savings, and stocks anyway, it's not clear who will be doing all the sustained, voracious consumption markets now are pricing in," BofA said.