Photo by Joe Raedle/Getty Images

- UBS Evidence Lab economists said job openings and retirement peaks may signify an end to the labor shortage.

- Job gains in leisure and hospitality are also promising signs that people are getting back to work.

- But bottlenecks, which slow economic growth, could prolong the labor shortage, they said.

- See more stories on Insider's business page.

The labor shortage is tough on the economic recovery. Consumers are spending and employers want to hire, but jobs can't get filled fast enough right now.

There's several signs that suggest the labor shortage will end soon, according to a Thursday note by the UBS Evidence Lab. But there's one big reason it might not.

UBS's Andrew Dubinsky, Pablo Villanueva, and Samuel Coffin wrote in a Thursday note that the labor shortage might be ending soon, given the increase in job openings and decline in retirement rates, among other things.

According to UBS, here are the three signs that the labor shortage could be ending:

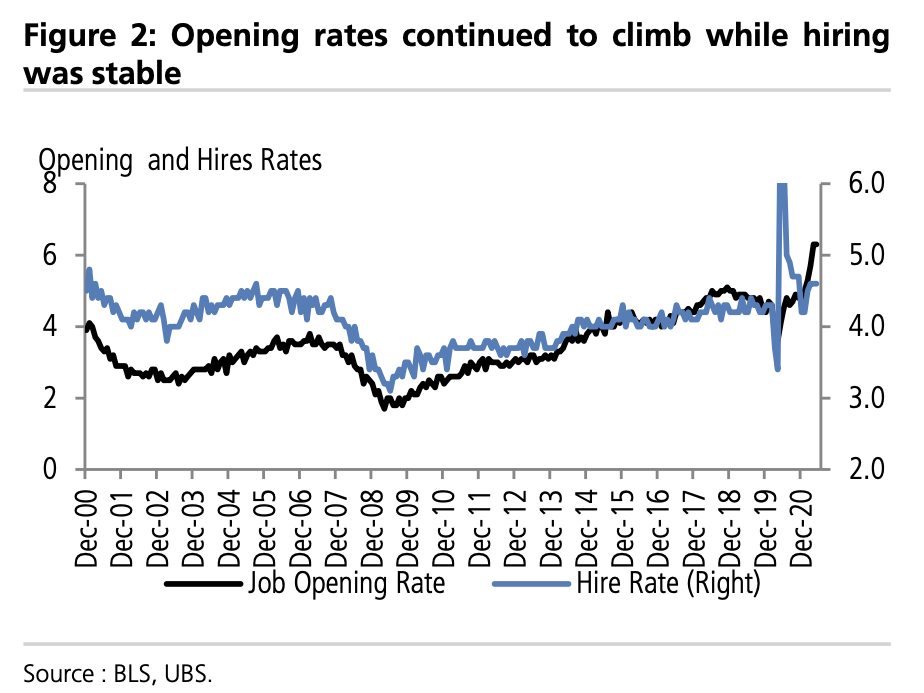

Job openings keep rising

The indicator that makes "the best case for continued strong job gains is job openings which have continued to increase through the end of May," the economists wrote.

They also note a drop in quit rates, which could suggest stable hiring rates accompanied by the job gains in May and June. The latter month added 850,000 payrolls, in the clearest sign that the shortage may be easing.

BLS, UBS

Insider previously reported that a factor behind the job openings could be workers holding out for higher wages, and given that a number of companies are beginning to increase wages to get people back to work, more jobs will likely be filled as a result.

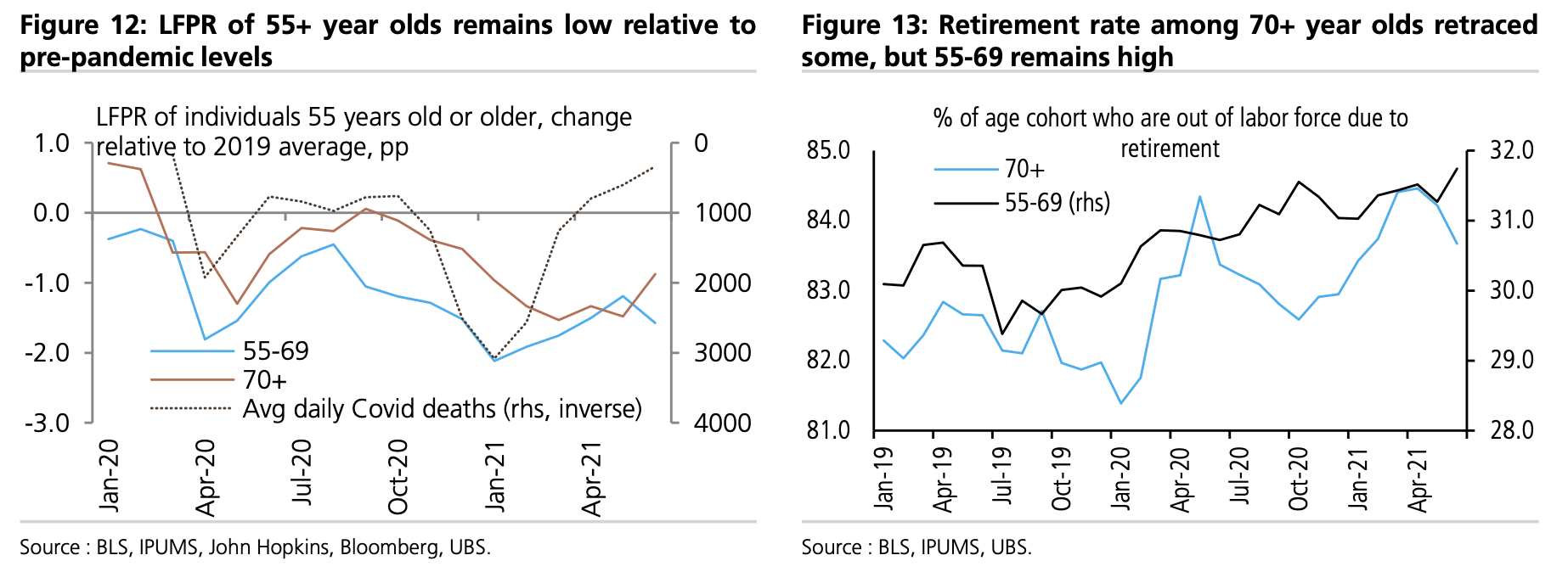

Retirements may have peaked

UBS found that retirements may have peaked for those aged 70 and older, which could help explain why participation rates are low.

BLS, IPUMS, John Hopkins, Bloomberg, UBS.

Other factors, like fear of contracting the virus and disruptions to childcare, are temporarily limiting the return to the workforce, the economists wrote, but they are expected to improve in the coming months.

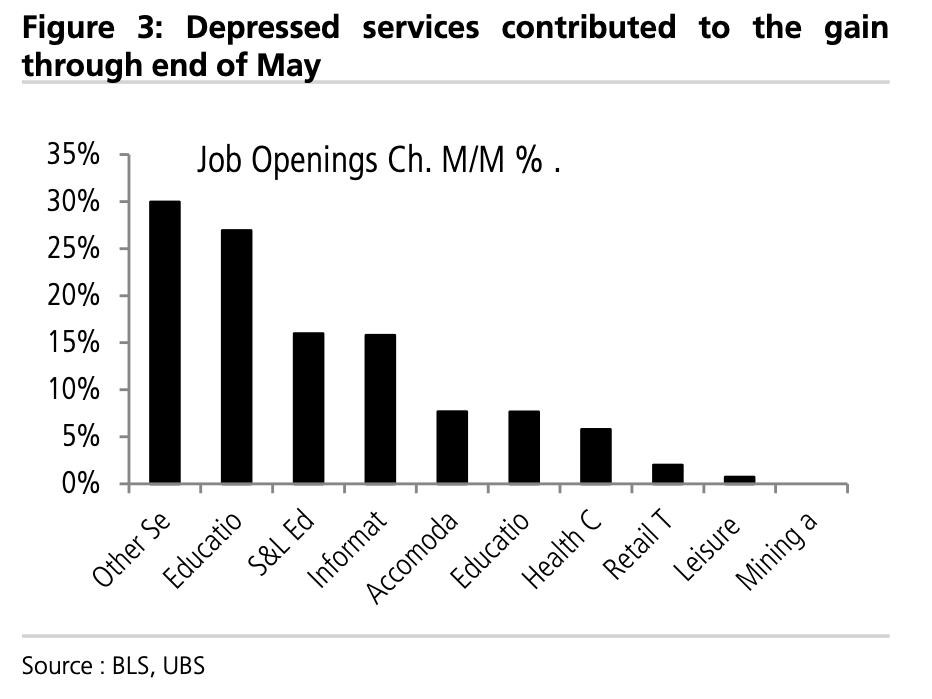

Service jobs added to the high level of job openings

The leisure and hospitality sector made up 40% of the total job gains in June, adding 343,000 payrolls, showing a promising sign for job growth in the service industry.

BLS, UBS

Pay in the sector also jumped 3.6% over the past three months, and the correlation between increased jobs and increased wages is suggesting that higher wages work. For the month of June, wages shot up 7.1% from a year ago, the biggest gain for any sector.

But these promising signs for the end to the labor shortage could be jeopardized by one thing: bottlenecks.

Bottlenecks occur when an industry has to slow its growth because it cannot keep up with demand, and the economists wrote that if bottlenecks don't fade, the labor shortage will likely persist. Job fillings remain slow from the bottleneck caused by the pandemic recession, but the drop in quit rates, along with wage gains, suggest bottlenecks might be fading, UBS said.

"If bottlenecks fade, openings and listings gains imply job growth trends should remain strong," it said.