- New data show early signs of the housing market finally easing after months of surging prices.

- Selling prices on Redfin fell in July – the first time they didn't set a new record in five months.

- Inventory is rebounding, and sales aren't happening with the same speed and bidding wars as before.

- See more stories on Insider's business page.

Prospective homebuyers may soon be able to breathe a sigh of relief. For the first time in five months, the housing market is cooling off.

What began as a buying spree in 2020 morphed into an affordability crisis in 2021 as demand for US homes handily outpaced the national supply. Bidding wars drove prices higher at record pace, and Americans began to back away from the red-hot market in June.

New data suggests it was wise to wait. Various indicators from real estate website Redfin signal the market hit its peak in July before reversing course. If the latest trends hold, houses could get more affordable for the first time in 2021.

Here are three (early) signs pointing to normalization in the US housing market.

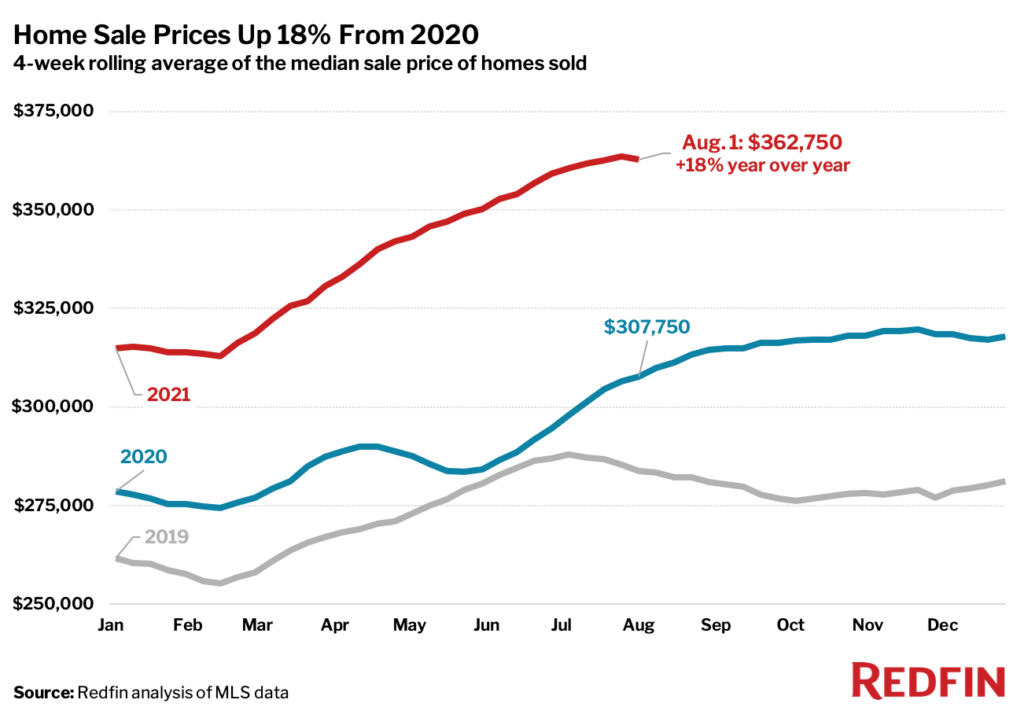

1. Selling prices are reversing their climb

The median price of a previously owned home fell 0.2% in the four weeks ending August 1, according to data published by Redfin on Friday. It's a small change, but in the right direction. The reading snaps five months of record-setting prices and marks the first decline since early March.

Redfin

Prices have a ways to fall before reaching last year's levels. The four-week average for sale prices sits 18% higher year-over-year. And economists interviewed by Insider only expect prices to rise more slowly, not return to their pre-crisis lows.

Still, this is the first sign of the price rally petering out.

"If these trends continue, homebuying conditions will likely improve (relative to earlier in the summer), with more options and less competition for homebuyers," Rachel Musiker, director of communications at Redfin, said in the report.

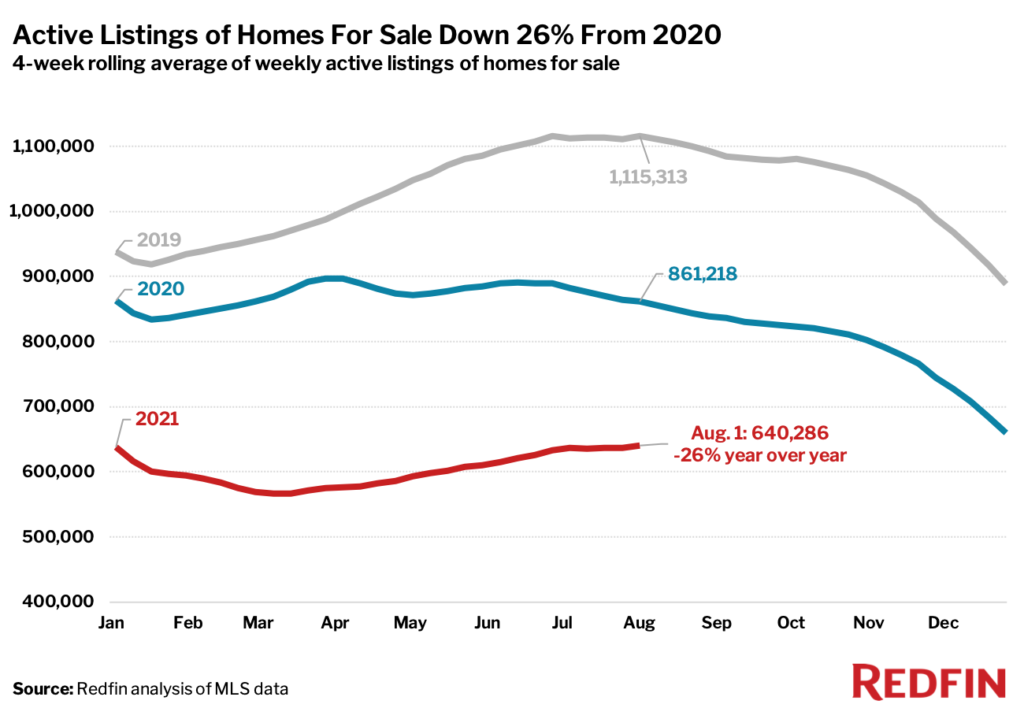

2. Inventory is bouncing back

The cooldown seems to be two-pronged. Weakening demand puts less upward pressure on prices, and greater inventory stands to give buyers more options. Putting more homes on the market cuts down on the bidding wars that sent prices skyrocketing through the pandemic.

Redfin

Redfin's average for active home listings rose slightly in July, continuing a steady uptrend after sliding in 2020 and early 2021. The gauge is still down 26% from its year-ago level, but that's the smallest shortfall since December 2020. It also sits 13% above its March floor.

Redfin's report matches trends in government data. The monthly supply of homes in the US rose to 6.3 months' worth in June, its highest level since April 2020 and nearly above it's pandemic-era peak.

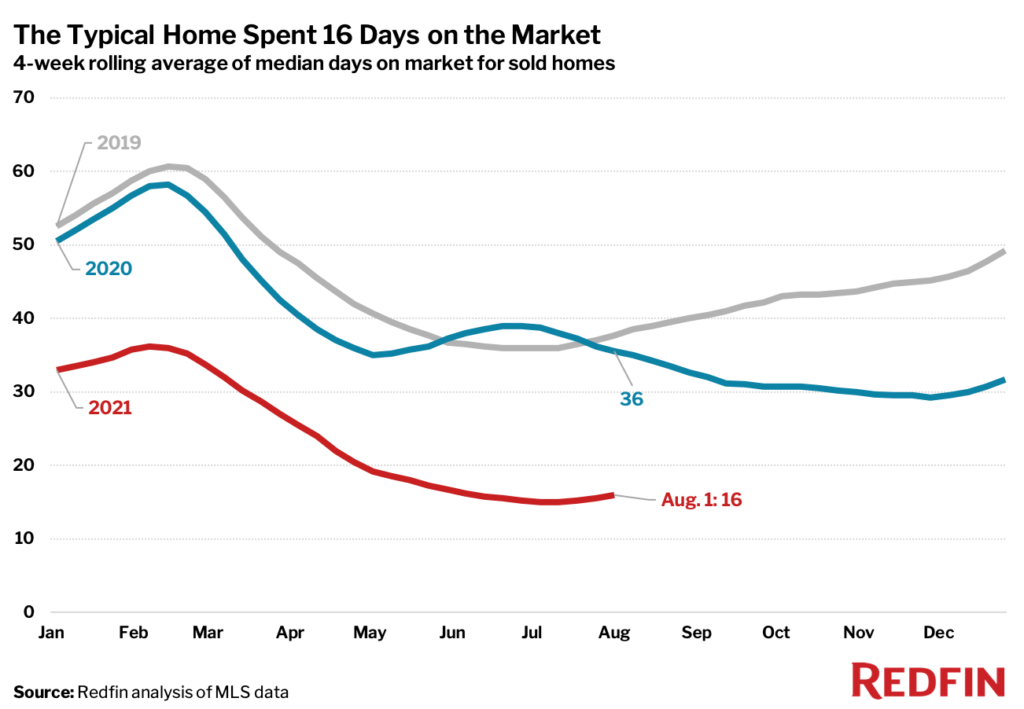

3. Competition is fading away

Sales also aren't closing with the same fervor of a few months ago.

For one, the average home spent 16 days on the market, up from the lows seen earlier in the month. Rapid-fire purchases became the new normal this year as buyers rushed to close deals before getting outbid.

Redfin

Just under half of homes that went under contract had an accepted offer in two weeks, according to Redfin. That's the first time the share fell below 50% since February.

For the first time since at least 2018, affordability was the main reason people were unable to buy a home, according to the National Association of Home Builders' Housing Trends Report. Bidding wars, the top-cited reason in late 2020 and early 2021, dropped to the second-highest spot on the list, suggesting the competition that characterized the housing crisis calmed somewhat.

It's not just buyers hitting the brakes. The share of listings with price drops rose to 4.7% in July, the highest since early 2019. The gauge is also on a strong uptrend, signaling sellers are coming to grips with the fact that buyers have had enough of such lofty prices.