- Disney has raised its offer for 21st Century Fox assets to $38 a share, or a total of $71.3 billion in cash and stock.

- The deal would allow 21st Century Fox shareholders to elect to receive cash or stock, subject to 50/50 proration.

- 21st Century Fox shares are up 6%, and Disney shares are up 2.2%.

- Watch Disney and 21st Century Fox trade in real time here.

Disney has raised its offer for 21st Century Fox assets to $38 a share, or $71.3 billion in all.

According to the press release, the terms of the deal are similar to Disney’s previous offer except that the new deal would allow 21st Century Fox shareholders to elect to receive cash or stock, subject to a 50/50 proration. Shareholders would receive the number of shares equating to a $38 price so long as Disney’s stock is trading between $93.53 and $114.32 at the deal’s close.

The increased offer comes one week after Comcast crashed Disney’s attempt to buy the assets with a $65 billion bid, following the US Justice Department’s approval of AT&T’s merger with Time Warner. Disney originally bid $28 a share back in December.

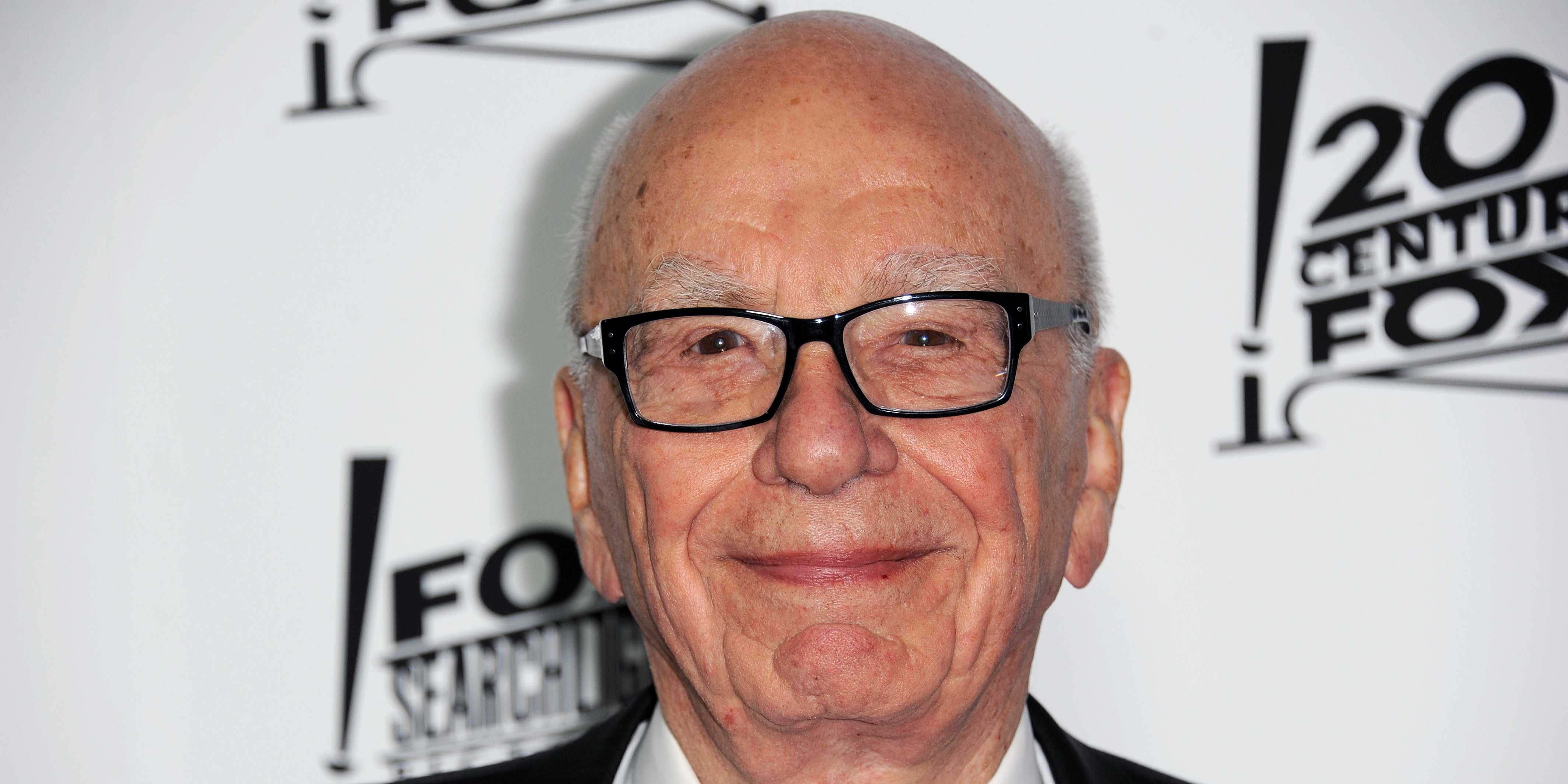

“We are extremely proud of the businesses we have built at 21st Century Fox, and firmly believe that this combination with Disney will unlock even more value for shareholders as the new Disney continues to set the pace at a dynamic time for our industry,” 21st Century Fox’s executive chairman, Rupert Murdoch, said in the press release.

"We remain convinced that the combination of 21CF's iconic assets, brands and franchises with Disney's will create one of the greatest, most innovative companies in the world."

The bidding war, however, may not be over just yet.

"Based on our merger models, we think bids from CMCSA or DIS could reach as high as $80 billion," John Janedis, an analyst at Jefferies, told clients in a recent note.

Shares of 21st Century Fox were up 6% on the news, while Disney's were up 2.2%.