Good morning! Here’s what you need to know in markets on Tuesday.

1. China’s financial markets have had another wild session.Both stocks and the Chinese yuan were off their earlier lows and trading was volatile, even by China’s recent standards. The Shanghai Composite Index was up about 1% about 15 minutes before closing. Meanwhile, US President Donald Trump said he thinks there will be “a great deal” with China on trade, but warned that he has billions of dollars worth of new tariffs ready to go if a deal isn’t possible.

2. The US government is about to issue $1.3 trillion in new debt this year. The debt issuance represents a 146% jump from 2017 and the highest amount of new debt issued since the recession.

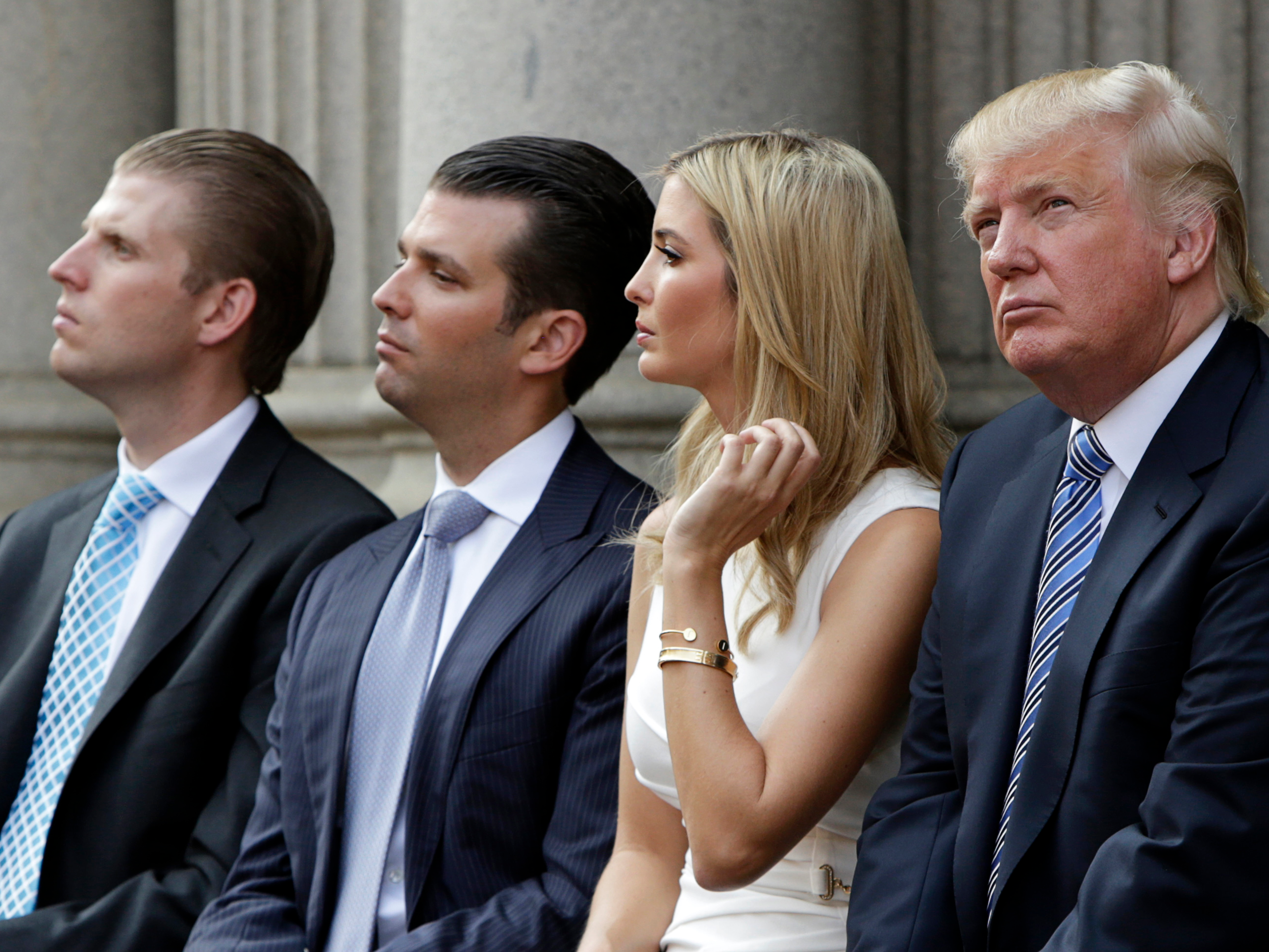

3. US President Donald Trump and his children have been accused of “deliberately” scamming Americans according to a complaint filed in federal court on Monday. The president allegedly went about encouraging people to invest in a very doubtful multilevel-marketing company for which he was reportedly paid millions.

4. Google employees are reportedly planning a walkout this week in protest of the recent sexual misconduct revelations.The New York Times reported last week that former employee Andy Rubin, the creator of Android,was paid a $90 million exit package when he left the company following a sexual misconduct investigation.

5. Evan Spiegel named a new chief business officer for Snap before giving the job to someone else two days later.Kristen O'Hara, the sales executive whom Spiegel first named to the job, has now left Snap.

6. The Pentagon is sending 5,200 troops to the border.President Trump has been focused on halting a caravan of Central American migrants inexorably moving north.

7. Facebook, Amazon, Netflix and Google were at the center of a volatile session on the US stock market on Monday, cleaving $200 billion off of the so-called FANG group's combined market capitalization in two sessions.

8. Billionaire investor Warren Buffett's Berkshire Hathaway now has investments in two emerging-market fintech startups, the Wall Street Journal reports. Back in August, Berkshire bought a $300 million stake in Paytm, the India-based mobile payments platform. Then last week, Berkshire bought shares in the IPO of Brazil-based payments provider StoneCo.

9. Every time President Donald Trump mentions the $110 billion arms deal he negotiated with Saudi Arabia last year, he quickly follows up, saying "It's 500,000 jobs." But if he means new US defense jobs, An internal document seen by Reuters from Lockheed Martin forecasts fewer than 1,000 positions would be created by the defense contractor, which could potentially deliver around $28 billion of goods in the deal.

10. South Korea has asked the US for "maximum flexibility" on its request for a waiver to prevent South Korean companies from being affected by renewed US sanctions against Iran. South Korea, a US ally and one of Asia's biggest buyers of Iranian oil, has already stopped crude imports from Iran. The sanctions against Iranian crude oil exports are set to take effect on November 5.