Welcome to 10 Things Before the Opening Bell.

If this was forwarded to you, sign up here. Plus, download Insider's app for news on the go – click here for iOS and here for Android.

Let's get into it.

1. US stocks slip with third-quarter earnings season on deck. The impact of labor shortages and the supply chain crunch on profits is in focus, as are oil prices rising to their highest level in years. Check out the latest in the markets here.

2. Mohamed El-Erian: Markets are telling the Fed to start tapering now after September job report flop. The latest jobs data showed 194,000 new jobs created in September, less than half of what economists forecasted. Here's how other experts responded to the weak numbers.

3. Earnings season is set to ramp up in coming weeks, and Bank of America's stock team is eyeing opportunities. The firm is especially fond of high-quality companies that have strong balance sheets and stable earnings. Read about BofA's top 20 picks here.

4. On the docket: Industrivaerden AB, COSMOS Pharmaceutical, and Himachal Futuristic Comm., all reporting.

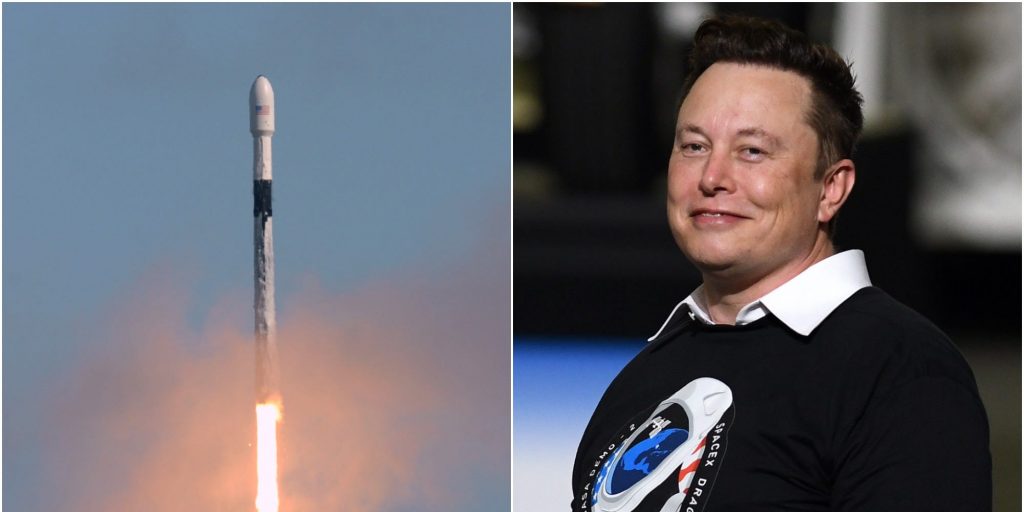

5. Elon Musk's SpaceX sees valuation jump 33% to $100 billion. The surge makes it the second-most valuable private company, behind TikTok parent ByteDance, which is worth $140 billion. Dig into the numbers here.

6. Bitcoin is in its 'rocketship' growth phase, according to a Gen Z crypto hedge fund founder. Even after passing the $1 trillion mark, the digital asset still has huge upside, said Rahul Rai. He expects bitcoin to continue to accelerate at an extreme rate.

7. The SEC could approve up to four bitcoin futures ETFs in October. SEC Chair Gary Gensler has been more receptive toward bitcoin futures ETFs, rather than funds that directly hold the digital asset. Here are the four applications that the SEC could approve this month.

8. After a quiet summer, lumber prices are increasing once again. Prices have jumped 50% since mid-August as inflation has steadily persisted and home prices have continued higher. Here's how this could end up putting pressure on the Fed for a policy change.

9. A 26-year-old breaks down how he came to own almost 1,300 rental units in 7 years. Abraham Anderson shares the type of loans he's used throughout the process. He also discusses the strategy that allowed him to scale fast.

10. A 15-year fintech veteran-turned crypto trader explains why he favors ether over bitcoin for the next 6 to 12 months. We spoke to James Putra, who oversees product strategy at TradeStation Crypto. He also shared the 2 altcoins in his portfolio.

Compiled by Phil Rosen. Feedback? Email [email protected] or tweet @philrosenn.Sign up for more Insider newsletters here.